Altcoin gains leave bitcoin gains in the dust… the fundamentals and technicals look healthy … one altcoin that has exploded, and could double from here

Before we jump into today’s Digest a quick note…

Our InvestorPlace offices will be closed tomorrow and Monday in honor of Labor Day.

If you need any help from our Customer Service team, they will be happy to assist you on Tuesday when our offices reopen.

We’ll be publishing the Digest us usual tomorrow, but will also take off Monday.

Have a wonderful Labor Day weekend!

Moving on to today’s Digest…

***If our crypto specialist, Luke Lango, is right, brace yourself

We believe the fundamentals, optics, and technicals all imply that this big rally could end up looking something like the 2013, 2017, and 2020 rallies in Bitcoin – and if so, that would put us in just the first inning of this 2021 breakout.

Needless to say, these are exciting times.

Bitcoin’s price action is exciting, and we do see the “poster child” cryptocurrency running to $100,000 within the next 12 months.

But more importantly, the opportunity in altcoins gets us most excited.

In today’s Digest, let’s review Luke’s most recent issue of Ultimate Crypto, which came out on Tuesday.

It covers bitcoin’s rally since July… the recent, explosive price action in certain top altcoins… continuing crypto adoption – both here in the U.S. and abroad… and we’ll even look at why the biggest gainer in the Ultimate Crypto portfolio – a 7,000%+ winner – might be doubling from here.

Lots to cover. Let’s jump in.

***Checking in with the grandaddy crypto first

For newer Digest readers, Luke is our hypergrowth investment expert. And few sectors offer greater potential for hypergrowth than cryptocurrencies. Altcoins have been some of the most lucrative investments of the past several years – some rising, literally, thousands of percent, creating fortunes in the process.

Now, even though Ultimate Crypto focuses on these cutting-edge altcoins, bitcoin is seen as the barometer of the crypto sector. So, this is where our analysis should start.

As crypto investors know all too well, bitcoin suffered a brutal bear market beginning in the spring.

From mid-April through late-June, it lost more than half of its value.

Source: StockCharts.com

Now, two important things about this…

First, while crypto bears gleefully declared this reflected bitcoin’s “fad” status, crypto investors saw this as nothing more than standard volatility.

As we’ve noted before in the Digest, heightened volatility is the price of admission for crypto investors.

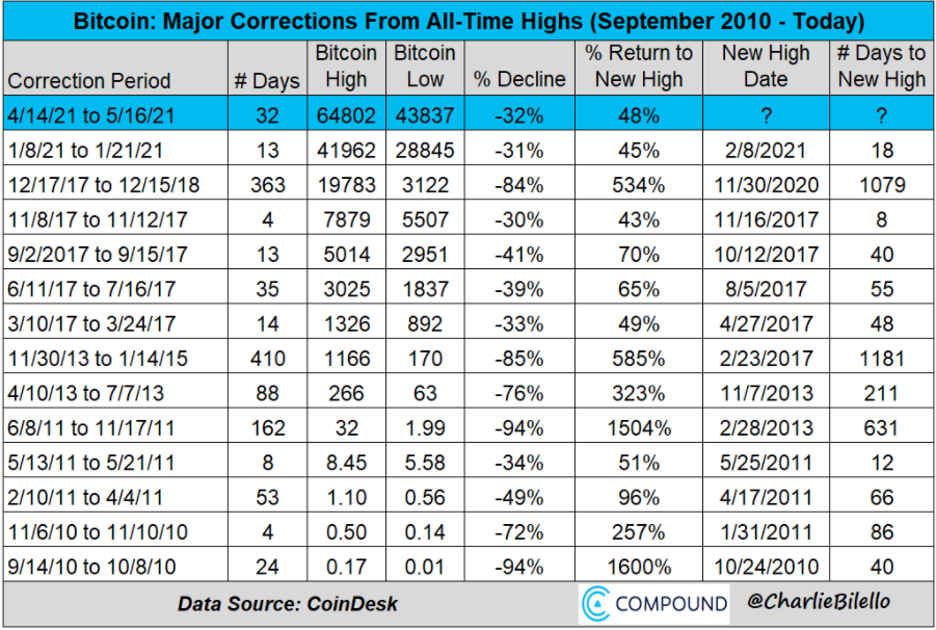

To illustrate, the below chart comes from Charlie Bilello. In the “% Decline” column, you’ll see how far bitcoin fell in various crashes over the last 11 years. And there are a lot of crashes.

But in the “% Return to New High” column, you’ll see the ensuing percentage return bitcoin tacked on in subsequent months on its way to a new high. And there are a lot of monster gains.

Source: CharlieBilello & CoinDesk

Though we’re not back to a fresh high, bitcoin has rallied 68% since its July low, as I write.

You should also know that Nasdaq.com’s research into bitcoin’s average volatility finds that its medium volatility (measured as 30-day standard deviations of daily log returns annualized) is between 50% and 100%.

Bottom-line – volatility is not the same as “risk.” Nor is it a sign of impending doom. It’s simply a characteristic of an asset – like a fingerprint.

When you expect exaggerated volatility and factor it into your investment plan, it’s a non-issue…though the financial media will do its best to make it an issue for you.

***The second point about bitcoin’s spring crash is that wise investors saw it as a buying opportunity

In fact, looking backwards, this crash followed a specific technical chart pattern.

In June – before bitcoin began rallying – Luke drew attention to this pattern. He wrote that it appeared to be a “Wyckoff” accumulation event.

Here he is to explain:

(A Wyckoff accumulation event is) a buying phase in which an asset’s price increases after selling off. The important takeaway is that the buying phase happens when individuals are selling out of fear and exhaustion, usually at a loss.

And guess who is happy to step in and buy at a discount? The institutions.

In Luke’s most recent issue, he provided the two charts below.

The top chart shows a hypothetical Wyckoff Accumulation pattern. The bottom chart shows bitcoin’s price action over recent months.

Notice any similarity?

Back to Luke:

The massive shakeout from May to June appears over.

It ended up looking much like a Wyckoff accumulation event. That’s good news because the market looks healthy and set to resume its upward trend.

So, bitcoin is appearing healthy and ready for more gains. That sets the stage for broader growth from the entire crypto/blockchain universe.

***Adoption is growing at home and abroad

Luke writes that the driving force behind blockchain’s disruption is its expanding presence around the world.

He cites a study by leading blockchain data analytics firm, Chainalysis. According to the study, worldwide adoption increased a staggering 880% year-over-year. That’s nearly 10X.

Back to Luke for specifics:

It’s worth noting where adoption is strongest.

Chainalysis ranked adoption in 154 countries around the world, and the top three were Vietnam, India, and Pakistan. The United States ranked eighth. The strongest adoption is in the emerging markets.

Another study tells a similar story. According to a report released by Crypto.com, a Hong Kong-based crypto exchange, the number of crypto users around the world grew to 221 million in June. That number doubled in just six months since the beginning of the year, and it increased 10% in one month from May to June.

No other industry is seeing this kind of explosive growth.

I’ll add that this widespread, global interest is especially encouraging as it shows that crypto’s overall health doesn’t depend on adoption by a single country, which could be impacted by prohibitive legislation.

***Here in the U.S., we could point toward any number of headlines illustrating bitcoin’s growth, but there’s an important story happening concerning altcoins

Last month, Coinbase CEO, Brian Armstrong, said he received Board approval to add $500 million in crypto assets to the balance sheet. The company would be investing 10% of future profits into crypto.

But here’s Luke with the critical detail:

The purchases will not be limited to Bitcoin.

This means Coinbase will look to diversify its balance sheet by adding other crypto assets like… you guessed it… altcoins.

We think this is a potential game changer for the altcoin space, as there will now be precedent for companies to invest in crypto assets other than Bitcoin and Ethereum, which is where much of the early money has gone.

So, which altcoins are receiving the bulk of these money-flows? And which appear most promising for investors today?

That brings us to the biggest returner in the Ultimate Crypto portfolio.

***Last month, we highlighted the altcoin, Cardano, which was soaring

The altcoin was racing higher because its founder had provided specifics about an upcoming “hard fork.” Without getting too technical, a hard fork is basically a radical change to the way a blockchain network works, resulting in “the old way” and “the new way” – like a fork.

Here’s Luke with why this is a big deal:

The final phase of the upgrade will enable Cardano to fully take on its main rival, Ethereum – the biggest smart contracts platform, with a market cap of around $396 billion versus Cardano’s $89 billion.

Ethereum has struggled with network congestion and higher transaction fees, so Cardano is well positioned to start taking market share immediately thanks to its higher throughput capability and cheaper gas fees.

In fact, Cardano’s plans to upend Ethereum are already well in motion…

Luke explains how it’s expected that Cardano will launch an ERC-20 token converter that will allow projects to seamlessly migrate assets from the Ethereum blockchain to the Cardano blockchain. This would be huge – like opening the floodgates to new Cardano adoption.

Luke points toward a decentralized artificial intelligence network called SingularityNET that has already made plans to migrate its native token, AGIX, from Ethereum to Cardano.

For reasons like this, Luke believes Cardano’s gains are far from done – even though Ultimate Crypto subscribers who bought according to the original recommendation are currently sitting on a 7,603% gain.

Here’s Luke describing what could be coming:

The average percentage move from the previous four consolidation phase tops to the next consolidation phase top is about 120%, so if a similar pattern plays out, the coin may climb toward $5 on its next leg higher.

As I write, Cardano trades at $3.02.

***Driving explosive gains like these from Cardano are technologies that are going to change our world

They’re ushering in this change through disintermediation.

Here’s Luke, explaining:

That’s a fancy word for “cutting out the middleman,” and this is a massive disruption.

Cryptos do serve to replace traditional fiat currencies, yes. But that is not their end goal – replacing the dollar, if you will, isn’t the “end game.”

They are a means to an end, and that end is economic disintermediation…

Altcoins are the smart application of blockchain technology.

They are projects, developed by a team of innovators on a decentralized network, geared to create breakthrough evolutions of today’s societal and economic systems that are freer, faster, and fairer.

Bottom-line, crypto adoption is picking up speed here in the U.S. and abroad. It’s not just bitcoin, it’s the entire sector. Best of all, we’re looking poised for another leg higher.

Here’s Luke’s final take:

So, sit back, buckle up, and enjoy the ride. You’re an early crypto investor. You know it’s going to be choppy at times. It’s going to be volatile at times. There are going to be some bloody days.

But you also know that you’ll survive those days, and that you’ll ultimately come out the other side with big gains.

Have a good evening,

Jeff Remsburg