There’s no denying that Advanced Micro Devices (NASDAQ:AMD) is a massive beneficiary of the artificial intelligence boom. With the potential to accelerate productivity, companies across industries have jumped aboard the AI bandwagon. Still, few seem to appreciate what’s under the sector’s hood. For this, I am getting skeptical and have a bearish outlook on AMD stock.

In theory, Advanced Micro should be able to snipe at Nvidia (NASDAQ:NVDA) and its stratospheric ascent. Recently, the company delivered blowout earnings, dismissing naysayers. However, as a rising number of critics note, Nvidia’s success could eventually harm it. Simply put, its products are getting too expensive due to skyrocketing demand. Therefore, competitor alternatives – hello AMD stock! – may rise to prominence.

This framework assumes that global AI demand will be robust and subsequently, the lift will sustain graphics processing units (GPUs). These specialized semiconductors help fuel the incredible bandwidth consumption that AI processes require. However, if that narrative doesn’t pan out, AMD stock could be in trouble along with the competition.

Given that shares have already soared 124% in the trailing year, it’s time for a reassessment.

AMD Stock Hinges on the AI Gravy Train

It’s quite clear that AMD stock hinges on the AI gravy train. Currently, the security trades at a trailing-year earnings multiple of 339.5X. And while it enjoys an impressive three-year revenue growth rate of 19.9%, investors are paying a revenue multiple of 12.63X. Both stats are well above the norm for the underlying semiconductor industry.

To that criticism, supporters of AMD stock and AI-related semiconductor firms respond with, of course it is! According to data compiled by Bloomberg, the generative AI market could be worth $1.3 trillion by 2032.

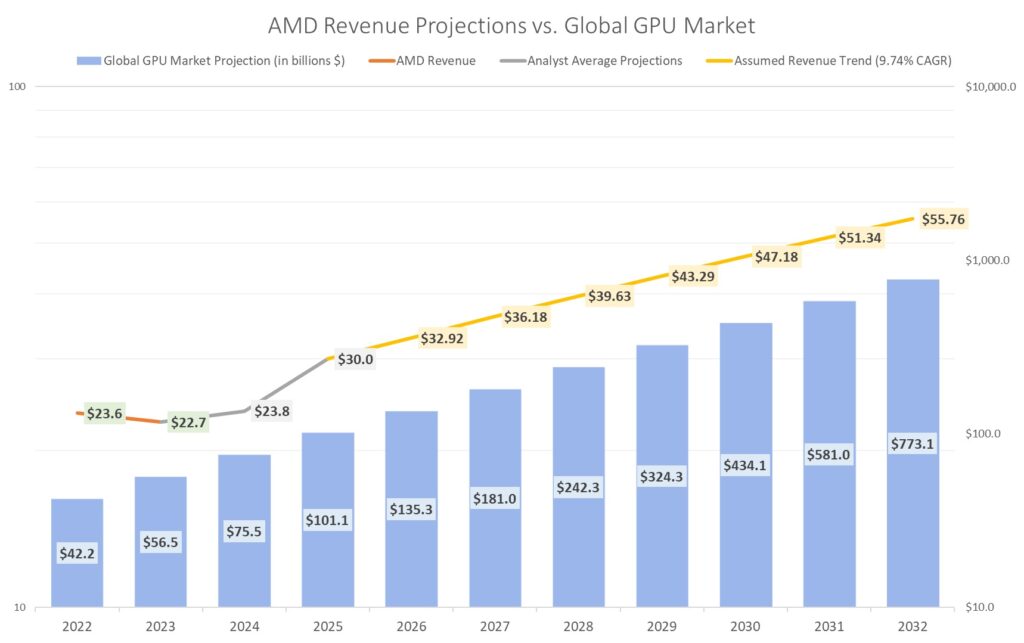

Obviously, advanced processors play a huge role in this burgeoning industry. Per Precedence Research, the global GPU market could reach $773.07 billion by 2032, implying a compound annual growth rate (CAGR) of 33.8% from 2023.

What’s more, the average analyst consensus calls for Advanced Micro revenue to reach $23.83 billion in 2024 and $30 billion in 2025. Based on the approximately 9.74% CAGR between 2023’s revenue haul of $22.7 billion to the projected sales of 2025, the company could possibly see sales of $55.76 billion by 2032.

Of course, a lot can happen until then. No one would look out a decade and base their core investing decisions on such a projection. Nevertheless, the bulls of AMD stock are right, if we assume that the generative AI market continues to expand. With the industry rising at a CAGR of 33.8%, one could make the argument that long term, AMD is undervalued.

Indeed, the highest analyst revenue target calls for 2025 sales to land $40.46 billion. Based on this growth rate, it’s possible that Advanced Micro’s sales could be over $120 billion by 2032. But how realistic is such sector growth?

AI’s Black Box Problem

According to information cited by MIT Sloan, a research study noted that highly skilled workers’ performance can improve by as much as 40% when they use AI platforms operating within the boundary of their capabilities.

I don’t disagree. The greatest chess players in the world would have trouble beating advanced chess computers – especially if they’re on the clock – because machines can calculate countless scenarios and permutations within seconds. However, not everyone plays chess and that’s the problem.

You see, the whole point of generative AI is that it can help humans with a range of dynamic and variable functions. We already have function-specific programs. What we need is a platform that can perform the heavy big-data lifting – finding trends in Advanced Micro’s financials and in the underlying industries it serves – to provide quality decision-making processes for humans; that is, whether AMD stock is a buy or sell.

Instead, we are left with AI platforms that sometimes can be cogent but other times is incredibly unhelpful or worse yet, downright inaccurate. Welcome to the black box problem. Long story short, AI protocols love giving you answer but it’s not clear how those answers materialized.

For example, in writing this story, ChatGPT gave me multiple incorrect answers for CAGR calculations. What was particularly damning was that it could not recalibrate to calculate the correct answer.

Unfair Value Destruction

Another reason I’m getting skeptical about AMD stock in the context of soaring AI fervor is the sector’s value destruction. Notably, education technology (edtech) names like Chegg (NYSE:CHGG) and more recently Coursera (NYSE:COUR) have struggled as generative AI threatens to disrupt their business models.

In theory, it makes sense. With chatbots like ChatGPT and Bard (now called Gemini), you can ask it anything you want. However, at some point, if the answers aren’t consistently correct, trust (or lack thereof) becomes a critical issue. Worst of all, if AI teaches incorrect processes to young students and ingrains them into their impressionable minds, it could cause large-scale generational dilemmas.

This dynamic points to a 2022 article by the Harvard Business Review. Simply, humans must still validate the insights and outputs that AI programs generate. But if such human oversight is necessary, that’s not value creation – that’s actually value destruction.

And so, the human-vetted edtechs that have been destroyed by ChatGPT and its ilk have been gutted unfairly. In other words, AMD stock trades as if generative AI will change the world for the better. But if it doesn’t, that means these AI plays will require a serious value recalibration to the downside. That’s why I’m skeptical.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.