Investing in Cathie Wood stocks means directing your money toward innovation. And that means investing heavily in tech, a sector that has been pummeled by interest rates held higher by a Federal Reserve battling runaway inflation. Cathie Wood’s portfolio can be found here and includes hundreds of holdings primarily in tech.

Wood’s ARK Investment Management includes several actively managed ETFs that focus on high-growth companies in fields such as genomics, robotics, and fintech. ARK’s most popular funds include the ARK Innovation ETF (NYSEARCA:ARKK), ARK Next Generation Internet ETF (NYSEARCA:ARKW), and ARK Genomic Revolution ETF (BATS:ARKG). Of course, any investor seeking to invest in Cathie Wood stocks could simply establish a position in any of those ETFs. That would be a reasonable method for following her investment methods. However, this list consists of individual stock picks all found within ARK’s respective ETFs.

| NVDA | Nvidia | $234.27 |

| TSLA | Tesla | $189.67 |

| NTLA | Intellia Therapeutics | $40.51 |

| ADYEY | Adyen | $14.43 |

| CAT | Caterpillar | $248.26 |

| CRSP | CRISPR | $48.18 |

| MGA | Magna International | $55.59 |

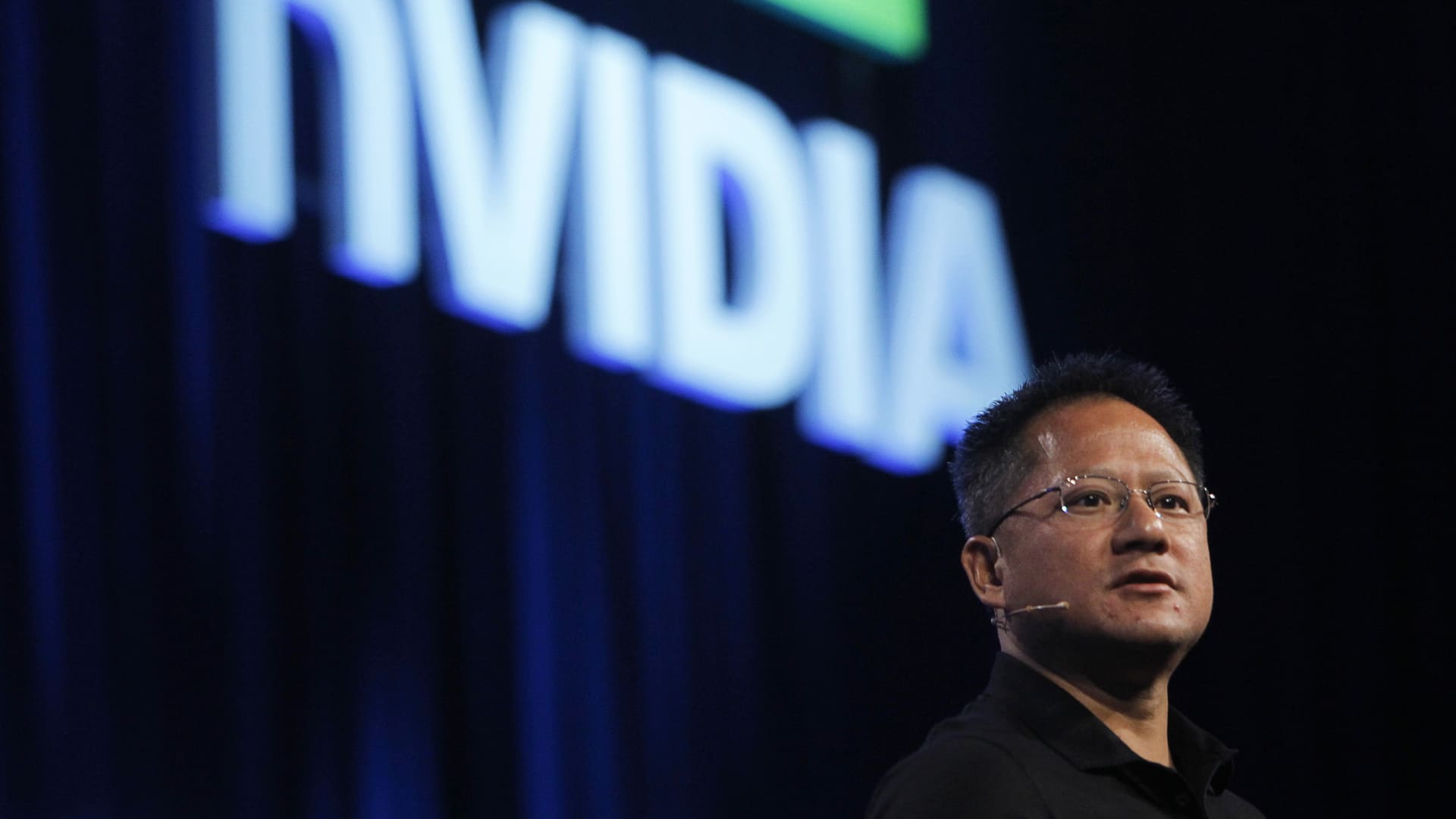

Cathie Wood Stocks: Nvidia (NVDA)

Most investors know Nvidia (NASDAQ:NVDA) as a leading semiconductor company that designs and manufactures advanced graphics processing units for gaming, data centers, and artificial intelligence. With all of those central to innovation, it should be no surprise that Nvidia is among ARK’s top holdings. The company’s shares provided investors with handsome returns throughout the pandemic era. Even now Nvidia remains at the forefront of innovation on many fronts. And it’s still garnering recognition for its place in the burgeoning AI realm. In fact, the company anticipates that by 2024, 60% of the 2000 largest enterprises globally will leverage AI across business-critical functions.

Cathie Wood Stocks: Tesla (TSLA)

Tesla (NASDAQ:TSLA) has a strong history of innovation and disruption in the automotive industry. Better, its shares represent the second largest holding in Wood’s ARK Investment Management, at 6.8%. ARK increased its Tesla holding by 13.3% in Q4. That decision has proven profitable in 2023 as shares have jumped from $108 to $190. Those shares also carry an average target price of $197 which would seem to suggest they are close to fully priced and dissuade some from buying now.

Even now, Tesla remains a growth machine. Q4 saw the EV pioneer record its highest-ever revenue, operating income, and net income ever. At the same time, things are far from perfect for the company. Automotive gross margins have been on the decline for quite some time, dating back to at least Q1 ‘21. But Tesla remains a growth story worth investing in, delivering 1.31 million vehicles in 2022. Fed rates will continue to introduce volatility into TSLA stock but in the long run, Tesla will prevail.

Intellia Therapeutics (NTLA)

Intellia Therapeutics (NASDAQ:NTLA) is part of ARK’s heavy stock investment into a gene editing and genomics industry that it highly favors. The firm specializes in developing gene-editing therapies based on the CRISPR/Cas9 technology. The company, and Wood, are betting on the promise of gene-editing technology in treating genetic diseases. Intellia Therapeutics’ focus on developing gene therapies for cancer, rare diseases, and other genetic disorders promises significant growth and returns for those investors.

2023 has been good to Wood’s signature ARKK Innovation ETF after it declined a massive 67%(1) in 2022. The company’s NTLA stock holding has not been among its losers, instead performing very well. ARK has purchased those shares at an average entry price of $35.13 and they have grown 16% to their current price.

Intellia Therapeutics recently received FDA clearance for its investigational new drug application related to its NTLA-2002 drug. That drug is a CRISPR-based therapy for the treatment of hereditary angioedema. That treatment inactivates a protein that causes angioedema, which triggers system inflammation in the body’s organ systems.

Adyen (ADYEY)

The fintech sector is full of stocks like Adyen (OTCMKTS:ADYEY) that promise to innovate the traditional finance industry. The Dutch-based company provides payment processing services to businesses worldwide. Growing demand for digital payments and e-commerce means that the company has a strong runway ahead. Further, its platforms support a range of payment methods and currencies that make it attractive to businesses everywhere.

I wrote about the company a few weeks ago just after it released earnings which saw the company’s revenues grow by 30% during the year to €1.3 billion. Ayden processed a massive €767.5 billion of payments for the entire year, representing 49% growth on a year-over-year basis. Ayden maintains business hubs across major financial hubs globally that include Singapore, Chicago, San Francisco, Madrid, and Sao Paolo. That global presence, combined with the fact that it serves multiple payment methods and currencies should help it to see continued strong growth, making it a strong choice among Wood’s fintech investments.

Caterpillar (CAT)

Caterpillar (NYSE:CAT) is a well-known heavy equipment, engine, and financial services company. It’s also a widely-held, well-known defensive stock broadly mimicking global economic growth. Wood’s ARK holds its because of the company’s strategic focus on digital transformation and innovation. CAT stock has shown impressive growth since the onset of the pandemic when prices fell to $92. Those prices currently stand at $252. However, Caterpillar’s prospects broadly mimic those of the global economy. So it should come as no surprise that share prices have run sideways since mid-2021.

Caterpillar continues to grow with top-line results that improved by 20% when it released earnings in late January. The company was able to pass higher prices on to buyers which led to $1.74 billion in sales during the most recent quarter. Like all firms with a significant overseas presence, the strong U.S. dollar muted gains as profits were remunerated to its U.S. headquarters.

CRISPR Therapeutics (CRSP)

CRISPR Therapeutics (NASDAQ:CRSP) is a pioneering biotechnology company in the development of gene-editing therapies based on the CRISPR/Cas9 technology. The transformative potential of gene-editing technology in treating genetic diseases has raised its stock and intrigued Wood’s ARK as well.

Crispr Therapeutics is something of an anomaly in the sense that it is fundamentally similar to many biotech upstarts but is actually well-established. The stock’s fortunes move more with narratives about its pipeline than its fundamentals. It reported no material revenues for all of 2022. In general, it depends on collaboration revenues for its top-line performance. In 2021, such collaborations resulted in $913.1 in revenues. Vertex Pharmaceuticals (NASDAQ:VRTX) was responsible for $900 million of that total upon the successful co-development of CTX001. That’s part of the allure of CRSP stock: Its technology is leveraged by other therapeutics firms that in turn pay for the lion’s share of development while Crispr reaps outsized rewards.

Magna International (MGA)

Magna International (NYSE:MGA) is a global automotive supplier that designs, develops, and manufactures a range of products. Its stock is a beneficiary of the EV boom, particularly the surge of SPACs that took EV firms public. Magna International is responsible for the production of Fisker’s (NYSE:FSR) Ocean SUV. So it’s easy to see why Wood was attracted to the firm’s connection to innovation within the sector.

The Ocean SUV is Fisker’s flagship EV after going public. The company chose to outsource production and in doing so likely saved itself. Many other EV SPACs overextended themselves by building manufacturing from the ground up while also marketing yet-to-be-produced EVs at the same time. And several of them are far behind Fisker currently. But by collaborating with Magna International Fisker was able to begin production on Nov. 17, as initially promised. That could lead to future contract manufacturing opportunities for Magna International. The company also picked up Veoneer’s active safety arm giving its business active driver assistance systems (ADAS) offerings that strengthen its vehicle innovation presence.

On the date of publication, Alex Sirois did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.