Stocks making the biggest moves after hours: LULU, MDB, FIVE

A Lululemon sign is seen at a shopping mall in San Diego, California, November, 23, 2022.

Mike Blake | Reuters

Check out the companies making headlines after the bell.

Lululemon — Lululemon’s stock popped 12% after the athletics apparel retailer posted better-than-expected fiscal first-quarter earnings and lifted its full-year guidance. The company also reported 24% sales growth from the year-ago period.

MongoDB — Shares of MongoDB jumped 19%. The data developer platform posted blowout guidance. MongoDB anticipates revenue in the second quarter will range between $388 million and $392 million, compared to analysts’ forecasts of $362 million, per Refinitiv. MongoDB beat on top and bottom lines in its latest quarterly report.

Five Below — Shares of the discount store chain jumped 6% in extended trading. Five Below posted earnings of 67 cents per share, while analysts polled by Refinitiv estimated earnings of 63 cents a share. However, Five Below posted revenue of $726 million, compared with Wall Street’s forecast of $728 million. Second-quarter guidance was also short of analysts’ expectations.

Broadcom — The chip stock fell nearly 1% in extended trading. Broadcom reported a beat on the top and bottom lines for its second quarter and fiscal third-quarter revenue guidance that came in slightly ahead of Wall Street’s expectations. The stock had risen 41% going into the report.

PagerDuty — Shares of the digital operations management company slumped more than 11% after the bell. PagerDuty reported adjusted earnings per share that beat Wall Street’s estimates, but issued weaker-than-expected revenue guidance.

Asana — Shares of the work management platform operator gained 2% postmarket. Asana reported a smaller-than-expected loss and revenue that beat analyst expectations in the first quarter, according to FactSet.

Samsara — Samsara’s stock popped 13% in extended trading after the Internet of Things company reported a smaller-than-expected first-quarter loss, according to FactSet. Revenue also came in ahead of Wall Street’s estimates, while full-year sales guidance expanded.

ChargePoint — ChargePoint shares slumped more than 4% in extended trading. The electric vehicle charging stock beat Wall Street’s earnings expectations but shared light guidance for the current quarter that was below consensus estimates.

SentinelOne — SentinelOne shares cratered 34% after the bell as the cybersecurity company cut its revenue guidance and fell short of Wall Street’s revenue expectations in the most recent period.

— CNBC’s Darla Mercado contributed reporting.

AI May Be the Only Way to Make Money These Days

The AI Boom is here, and folks, it is just getting started.

Call it a bubble. Call it overrated. But it’s neither. AI is the biggest technological paradigm shift since the internet. It is the real deal. It’s going to change the world.

And, unless you prepare for it, AI will kill your investment portfolio, too.

Why?

Because AI will permanently split society. You may think we live in a world of “haves” and “have-nots” today. But that divide is only going to get so much bigger in the Age of AI.

I’m not even talking about the whole “AI is going to take your job” idea. That will certainly happen to some of us. But we will find work elsewhere. Society always figures these things out.

Rather, I’m talking about the generational divide forming in the stock market. AI stock investors will get filthy rich, and all others will spend the next decade playing catch-up.

That is, companies that make, sell, and use AI effectively will eat up entire industries and become titans of business. In that process, they’ll destroy all the companies that don’t do the same.

The result? Stocks on the right side of the AI divide will soar; and not just this year but for the next 10 years. And stocks on the wrong side will crash.

We’re already seeing this play out right now.

AI Is Powering a Generational Shift

You may have noticed. Stocks are up this year, but the rally has been very narrow. In fact, tech and AI stocks are essentially the only stocks participating.

They are soaring. Pretty much everything else is down!

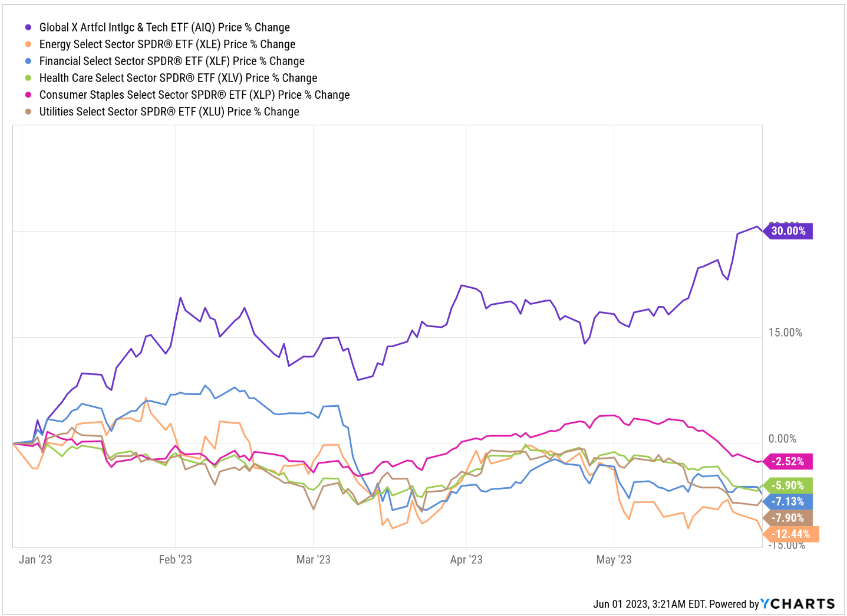

The Global X Artificial Intelligence ETF (AIQ) is up 30% this year. Meanwhile, consumer staples stocks are down 3%. Healthcare stocks slid 6%. Financial stocks fell 7%. Utility stocks are down 8%, and energy stocks have been clobbered by 12%.

AI stocks are soaring. Everything else is dropping.

This isn’t unusual during a new tech paradigm shift.

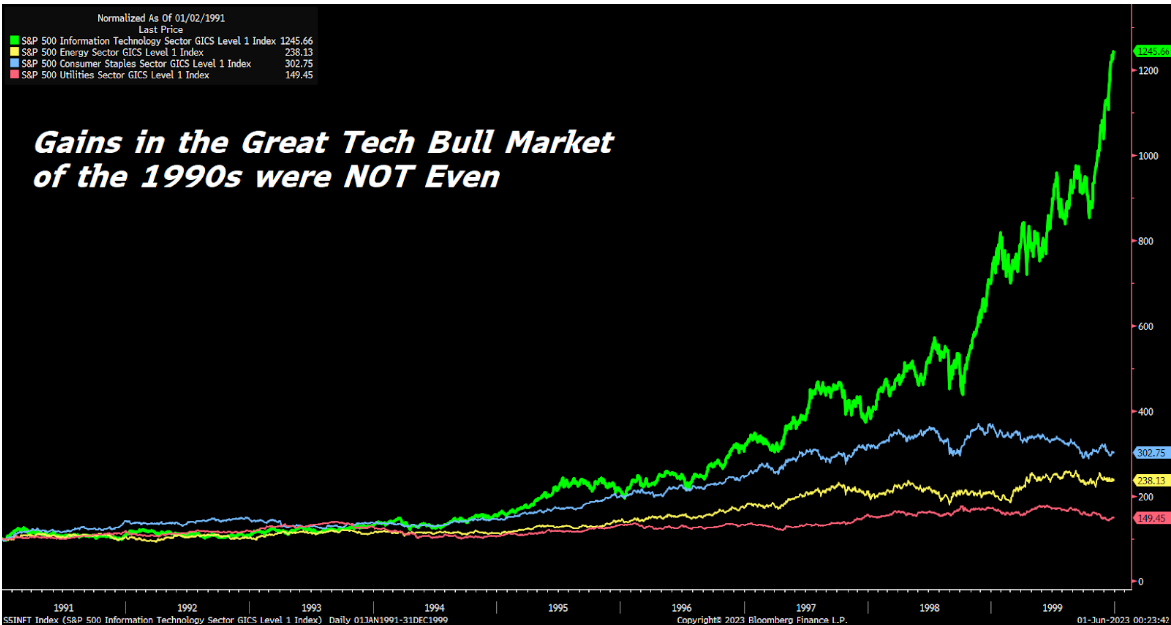

The last time we saw a shift this big was in the early 1990s with the emergence of the internet. Back then, internet stocks started outperforming all other sectors in the market – and they didn’t stop outperforming for a whole decade.

Throughout the 1990s, tech stocks soared more than 1,100%. Meanwhile, consumer staples stocks rose just 200%. Energy stocks gained less than 140%, and utility stocks added just 50%.

I don’t mean to scoff at a 50% gain. But over the course of a decade? That’s not too impressive – especially when investors had the chance at more than 20X greater returns with tech stocks.

Well, let’s just say investors who didn’t buy internet stocks in the early 1990s are still kicking themselves today.

This is especially true when we look at individual stocks.

The Path to Making Millions

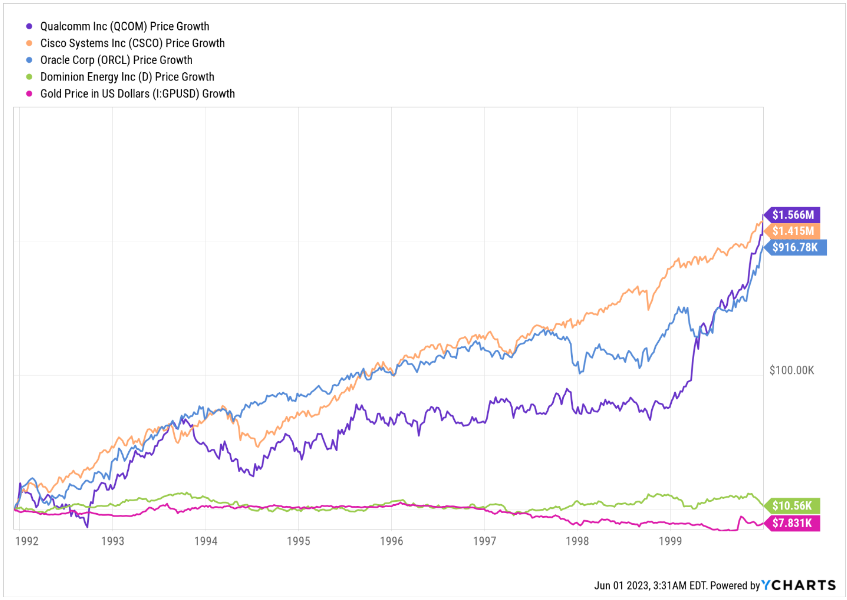

Had you invested $10,000 into internet leader Oracle (ORCL) in 1991, you would’ve turned that $10K into over $900,000 by ‘99. A $10,000 stake in Cisco (CSCO) would’ve turned into $1.4 million. And a $10,000 stake in Qualcomm (QCOM) would’ve grown to over $1.5 million.

Now, let’s say you ignored the internet boom of the early 1990s. You called it a bubble. You said it was overrated. Instead of investing $10,000 into Qualcomm, you put that money into a safe utility stock like Dominion Energy (D). By 1999, you would’ve had a whopping $10,500.

Or, let’s say you played it really safe and bought gold. By 1999, that $10,000 would’ve turned into… wait for it… $7,831.

You get the point, right?

Investors who bet on the right internet stocks at the dawn of the internet in the early 1990s turned thousands into millions. Investors who called the internet a bubble in the early ‘90s and bought safe utility stocks or gold just broke even, at best.

We find ourselves in a similar situation today.

Investors who bet on the right AI stocks now – at the dawn of AI in the early 2020s – are giving themselves the chance to turn thousands into millions. Investors who call this a bubble and buy safe utility stocks instead likely won’t make much (if any) money over the next decade.

Of course, the choice is yours.

But we think the right choice is obvious.

The Final Word

And, lucky for you, we have the top AI stock for you to buy today.

No, it’s not Nvidia (NVDA) – the current poster child for the AI Revolution. In fact, we just sold some of our Nvidia position for nearly 1,000% returns earlier this week.

This company is actually much better – and could one day be much bigger.

It is a brand-new firm, developing next-generation computer chips that we believe will power all future AI software.

These computers will be the foundation of the AI Revolution. That’s why this company could be the next Nvidia!

The best part? The stock of this firm is currently trading for less than $15.

But time is of the essence here – because this tiny stock is already up about 220% in 2023 alone!

Investors are starting to hear about this breakthrough tech stock. And amidst the AI frenzy, they’re buying it up in a hurry.

Get in on the next big AI stock before it explodes to the moon.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Beware! LCID Stock Has Yet to Hit Rock Bottom.

Since mid-May, shares in Lucid Group (NASDAQ:LCID) have found some support from the market. During this time, LCID stock has experienced a double-digit percentage rally, moving from around $7 per share, to around $7.75 per share.

With this slight rally, some investors may now believe shares in this electric vehicle (or EV) stock has finally bottomed-out, and that a recovery is starting to take shape. However, in my view, there’s little out there backing this take.

What’s been driving this rally is small potatoes compared to this fledgling upstart’s many problems. Chances are enthusiasm about these developments will be fleeting.

Worse yet, there’s still much in play that could drive a reversal for LCID following its recent rally, sending shares not only to past price levels, but to even lower prices. With this in mind, take a closer look, and see why it’s still wise to stay away.

Built on Shaky Ground

Lucid Group may be back on an upward trajectory, but it’s not as if there has been substantial positive news out of the company lately. It’s been about three weeks since the last spate of company-specific news, and that news (Lucid’s latest quarterly earnings report) was far from a positive for the stock.

So, if not something major like better-than-expected results, or upward revisions to guidance, what has exactly sparked renewing interest in LCID stock? As mentioned above, chalk it up to recent headlines that are not exactly consequential to the overall story with Lucid.

That is, there’s been some news with an incumbent automaker throwing its hat into the EV ring which is lifting the other “boats” (i.e. other EV stocks), Lucid stock included. In short, this latest rally is built on shaky ground. Forget about LCID climbing higher for much longer.

In fact, as of this writing, this rally appears to be starting to lose momentum. A shift back to a downward trajectory may be next. That’s not to say that this EV stock is primed for a sharp, rapid plunge. However, an extended slide in price could soon kick off. Here’s why.

This EV Contender is Turning into a ‘Never Was’

Back in 2021, investors aggressively bid up LCID stock. Largely, on the view that it was the top candidate to give EV market leader Tesla (NASDAQ:TSLA) a run for its money.

Throughout 2022, the market walked back its expectations for Lucid Group, as the company faced production and sales-related headwinds. Now, in 2023, not only is the view that Lucid is a potential “Tesla killer” is laughable. Hopes that this company will at least become moderately successful are withering away.

Expect this shift, which will end with the budding EV contender getting deemed a “never was,” to continue. As I argued recently, with Lucid’s underwhelming production numbers for the first quarter of 2023 (2,314 vehicles), it’s doubtful the company has the potential to hit its already-lackluster full-year production target (10,000-14,000 vehicles).

Deliveries last quarter came in at only 1,406 vehicles, down more than 27% from the level of deliveries (1,932 vehicles) reported for the quarter preceding it. This sharp drop in sales casts significant doubt that this brand is growing in popularity. If Lucid reports similar numbers in the coming quarters, shares will likely drop to new lows.

Bottom Line

Alongside sentiment about Lucid’s prospects, there’s another factor that could hammer LCID lower. It has to do with the EV maker’s high level of cash burn. Last quarter, the company reported negative operating cash flow of over $800 million.

With its cash position totaling $3 billion at present, Lucid may be a few quarters away from running on empty.

Yes, Lucid’s majority owner, Saudi Arabia’s Public Investment Fund (or PIF) still appears willing to provide Lucid more financing as needed, given its role in the oil-rich kingdom’s efforts to diversify its economy.

However, while Lucid may continue to have a deep-pocketed backer in its corner, don’t assume that could potentially save the day for LCID. The dilution from such capital raises stand to knock the stock even lower.

As before, staying away is your best move with LCID stock.

LCID stock earns a D rating in Portfolio Grader.

On the date of publication, neither Louis Navellier nor the InvestorPlace Research Staff member primarily responsible for this article held (either directly or indirectly) any positions in the securities mentioned in this article.

3 Data Center REITs With Attractive Dividends

Real estate investment trusts (REITs) are particularly appealing for income investors. REITs widely have high dividend yields, well above both the market average and most other market sectors. With the S&P 500 Index yielding just 1.7% on average, it is a good time for income investors to consider this type of investment.

The best REITs display a track record of growth, in addition to their sizable dividend yields. Data center REITs typically own properties that are a combination of data centers that store and process information, technology manufacturing sites and internet gateway datacenters.

This article will discuss three top data center REITs for investors to consider.

Digital Realty (DLR)

Source: dotshock / Shutterstock

Digital Realty (NYSE:DLR) owns more than 300 facilities in 28 countries on six continents. The REIT is a leader in the data center space. In the most recent quarter, revenue increased 19% year-over-year while core FFO-per-share was roughly flat year-over-year.

Acquisitions are a major component of Digital Realty’s growth strategy. In 2017, Digital Realty completed its purchase of DuPont Fabros Technology, a REIT that leased properties to some of the largest tech companies in the world. More recently, Digital Realty added Interxion, gaining exposure to the European cloud industry.

Digital Realty’s dividend payout ratio (using FFO instead of earnings) is comparatively low for a REIT. That should give shareholders confidence that the dividend is relatively safe. Digital Realty’s chief competitive advantage is that it is among the largest technology REITs in the world. This gives the REIT a size and scale advantage that competitors have difficulty matching. In addition, the company has proven to be able to utilize its balance sheet to fund acquisitions in order to grow FFO and revenues.

The REIT has increased its dividend for 17 consecutive years, including a 5% dividend hike in 2022. For 2023, the company expects to generate $6.65 to $6.75 (unchanged) in core FFO-per-share. This easily covers the dividend and should allow for continued increases. The stock yields 5%.

Equinix (EQIX)

Source: Ken Wolter / Shutterstock.com

Equinix (NASDAQ:EQIX) operates 248 data centers across 32 countries on six continents. It serves more than 10,000 customers. The REIT operates an attractive business model, as over 90% of its total revenue is recurring.

Its business services include colocation, interconnection, managed infrastructure and other. Its offerings allow customers to connect directly, securely and dynamically within and between other EQIX data centers around the globe. There are currently more than 452,000 total interconnections.

EQIX also has a highly diversified client base. This includes major telecoms, mobile and network service providers, cloud and IT service providers, and financial services companies.

Equinix reported first-quarter 2023 results on May 3. Revenue grew 15% year-over-year to $2 billion. The company has achieved 81 consecutive quarters of revenue growth. Adjusted funds from operations (AFFO) increased 21% year-over-year to $8.59. Interconnection revenue grew 9% year-over-year.

Equinix continues to expand on its platform and has 50 major projects in development across 37 markets. Management provided 2023 annual guidance and expects a roughly 13.5% increase in revenues to $8.23 billion. Guidance also calls for AFFO of roughly $2.97 billion, a 9.5% increase over 2022. They also estimate AFFO per share gains of 6.5% to $31.58.

EQIX has grown revenues for 20 years straight. Plus, the company’s bottom line has also been on a straight uptrend for over a decade. For the past nine and five years, Equinix has been able to grow its AFFO at an average annual rate of 10%.

Its major competitive advantage is its global platform spanning 32 countries. It contains the industry’s largest and most active ecosystem of partners in their centers, creating a network effect that improves performance and lowers cost for customers. The trust has an investment-grade S&P Credit Rating of BBB and a consolidated net-debt-to-adjusted-EBITDA of 3.4x. That is within the 3-4x range set by management.

EQIX is a strong REIT for dividend growth. On Feb. 15, Equinix announced a 10% increase to the dividend to $3.41 quarterly per share. It has increased its dividend for seven consecutive years. The payout ratio for EQIX is calculated as dividends per share divided by AFFO. The average five-year payout ratio of 43% is well-covered and leaves plenty of room for growth. Shares currently yield 2%.

Iron Mountain (IRM)

Source: Shutterstock

Iron Mountain (NYSE:IRM) is a storage and information-management REIT. Its services include record management, destruction, fulfillment services, data protection and recovery, server and computer backup services, and safeguarding of electronic and physical media.

Iron Mountain reported its fourth-quarter earnings results on Feb. 23. The trust announced that it generated revenues of $1.28 billion during the quarter, which was up 10% from the revenues that Iron Mountain generated during the previous year’s quarter. Normalized FFO-per-share of 74 cents was flat year-over-year. Margins were steady as well.

Iron Mountain is not a high-growth investment trust, but it still managed to increase its cash flows per share by 4% annually since 2009. Growth has been driven by several factors, with organic revenue growth through pricing increases being the most important one. Iron Mountain guides for 3% to 5% annual organic revenue growth in the future

Management announced its guidance for this year’s adjusted FFO-per-share with a range of $3.91 to $4, which represents solid growth of around 4% at the midpoint of the guidance range, relative to 2022, which had been a record year for the company.

Due to the weaker growth rate during the last decade, we use a somewhat lower estimate for Iron Mountain’s long-term cash-flow growth. Following a small profitability decline in 2019, Iron Mountain was able to grow its funds from operations to new record levels in both 2020, 2021 and 2022. It is expected that the company will be even more profitable this year. That growth will continue at a meaningful pace beyond the current year.

With a dividend payout ratio of approximately 63% for 2023 (based on FFO per share), the dividend appears secure. Shares currently yield 4.5%.

On the date of publication, Bob Ciura did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

What Is an ETF?

NRG Energy to boost stock repurchase program by $650 million after sales of STP stake

Shares of NRG Energy Inc.

NRG,

rose 1.5% toward a 6-week high in premarket trading Thursday, after the home-services energy company authorized an additional $650 million in stock repurchases. The new authorization will follow the closing of the deal to sell 44% of its interest in South Texas Project Electric Generating Station (STP) to Constellation Energy Corp.

CEG,

for $1.75 billion, which is expected to occur by the end of 2023. With $350 million remaining in NRG’s existing share buyback program, the total repurchase authorization will increase to $1 billion, which represents 12.9% of the company’s market capitalization of $7.78 billion as of Wednesday’s close. NRG’s stock has gained 6.2% year to date through Wednesday, while Utilities Select Sector SPDR exchange-traded fund

XLU,

has lost 7.9% and the S&P 500

SPX,

has advanced 8.9%.

Ford launches pilot program that allows Uber drivers lease electric vehicle for customized time period

Ford Motor Co. F said Thursday it has launched a pilot program that will allow Uber drivers going electric to lease vehicles for more customized time periods. The pilot program has started in San Diego, San Francisco and Los Angeles, where Uber UBER drivers can now sign up on the Uber marketplace. “A flexible lease allows rideshare drivers to select their Mustang Mach-E for between one- and four-month increments, depending on the location,” Ford said in a statement. The vehicle is delivered to the driver within two weeks, and they can use the Ford Drive app to manage payments and service. California is Uber’s biggest…

3 High-Potential Small-Cap Stocks for Investors With Strong Stomachs

When looking for big winners in the stock market, smaller is better. A gigantic firm like Apple (NASDAQ:AAPL) can realistically only go up so much in a given time period. Simply put, iPhone sales aren’t going to triple anytime soon. High-risk high-reward small-cap stocks, on the other hand, can have tremendous near-term upside if things go correctly for the company.

To be clear, these are the top small-cap stocks for people with strong stomachs. Volatility will be a given. And there is a real risk of failure if these companies aren’t able to deliver on their business models.

But, for investors willing to endure some risk, these high return small-cap stocks could be multi-baggers over the next few years. As such, let’s take a look at these three promising companies today.

| LLAP | Terran Orbital | $1.18 |

| PACW | PacWest Bancorp | $6.52 |

| CLPT | ClearPoint Neuro | $7.70 |

Terran Orbital (LLAP)

Terran Orbital (NYSE:LLAP) is a high-risk high-reward small-cap stock focused on the space industry. At less than $1.25 per share and with a market capitalization of less than $200 million, Terran Orbital is a positively tiny company by Wall Street standards.

However, it has a ton going for it. It has a unique small satellite design, and is already in commercial production. Terran Orbital brought in $94 million of revenues last year. Defense contracting giant Lockheed Martin (NYSE:LMT) gave Terran the best sort of validation with a $100 million investment last year to bolster its manufacturing capacity.

Terran added to this momentum in February with a truly massive deal. It announced that it had signed a $2.4 billion contract with Rivada Space Networks for a total of 300 spacecrafts. This will include 288 low-earth satellites and 12 spare units. This is a simply stunning deal, with $2.4 billion coming in at more than 10 times today’s market capitalization for Terran Orbital.

There are still plenty of risks. Even with Lockheed’s investment, it appears Terran Orbital will need to raise a lot more capital to build out its manufacturing. Bank of America recently downgraded LLAP stock on financing risks. That said, the Rivada deal shows Terran’s tremendous potential. If management can build off of that momentum, the sky is the limit.

PacWest Bancorp (PACW)

PacWest Bancorp (NASDAQ:PACW) is a regional bank focused on the California market. After the failures of Silicon Valley Bank, First Republic Bank and several others, traders are looking for the next bank to sell short to zero.

PACW stock became one of the leading targets. Shares fell from a 52-week high of $32 to as low as $2.48 in recent weeks. It appeared that PacWest might not be able to survive.

However, PacWest shares have surged recently. The company’s deposit base hasn’t shrunk nearly as fast as the bears had predicted. The bank has posted collateral at the Federal Reserve to free up more liquidity. Meanwhile, PacWest was able to sell a hefty construction loan portfolio at only a modest loss, which gives it more capital to continue navigating through the current storm.

PacWest earned $5.10 per share in 2021 and $3.37 in 2022. Its profitability will be significantly hampered for the intermediate future given the deposit crunch and unfavorable interest rate environment. But if the bank can merely hold on and things start to normalize, shares should have tremendous upside from the current $7 stock price.

ClearPoint Neuro (CLPT)

ClearPoint Neuro (NASDAQ:CLPT) is a small biotech company focused on improving brain treatments. Specifically, it has the SmartFlow Cannula system which allows medical professionals to deliver drug therapies directly into the brain, bypassing the blood-brain barrier. This potentially has a wide range of clinical applications.

The SmartFlow Cannula system already has significant commercial traction with more than 5,000 units sold to-date. This figure should continue to grow as more companies develop approved treatments which utilize the Cannula system as the delivery mechanism.

For one recent example, PTC Therapeutics’ (NASDAQ:PTCT) Upstaza, which treats AADC deficiency, received approval in the EU and the United Kingdom last year. That makes it the first approved gene therapy to be injected directly into the brain, and it uses ClearPoint’s proprietary delivery technology. These sorts of drug approvals should lead to long-lasting revenue streams as ClearPoint locks itself in as the delivery mechanism for these cutting-edge brain therapies.

ClearPoint hasn’t yet reached profitability. However, the company grew revenues from $7 million in 2018 to $21 million last year, and its operating losses are shrinking. As more biotech firms have success, ClearPoint should be able to start making money and obtain a much higher valuation from the market for its cutting-edge drug delivery platform.

On the date of publication, Ian Bezek held a long position in LMT stock. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

3 Financial Services Stocks to Avoid Like the Plague

Navigating the financial sector’s tumultuous waters has been incredibly challenging, especially with the unexpected collapse of Silicon Valley Bank in March. This event has cast a long shadow over the sector, causing bank shares to struggle and putting Wall Street on high alert.

Amidst this uncertainty, short-sellers and fundamental investors seeking value are looking to assess when the other shoe with drop. In this context, it’s imperative to identify the “financial services stocks to avoid.

The iShares U.S. Financial Services ETF (NYSEARCA:IYG), a popular ETF tracking banking stocks, has dipped into the red, shedding over 4.4% compared to the S&P 500‘s gain of more than 9.5%. This situation underscores the importance of assessing the risky financial stocks to avoid. Moreover, the worst-performing financial services stocks have been under discussion in this article piece.

Financial Services Stocks To Avoid: Prudential Financial (PRU)

Financial services firm Prudential Financial (NYSE:PRU) is now navigating choppy waters. Though it delivered a relatively strong performance in the first quarter, its performance in the second half of the year should have its investors in sweats. Assets under management were down 12.5% from the previous year in the first quarter, a sign for things to come ahead.

Another massive consideration for the firm is its sizeable commercial mortgage-backed securities (CMBS) portfolio. The firm is in a precarious position, with the commercial real estate market showing signs of a major downturn. A significant drop in commercial real estate values, as predicted by Morgan Stanley, is likely to have a profound impact on Prudential’s financial health.

Therefore, as we move forward, the road ahead for Prudential appears to be a mixed bag of challenges and opportunities.

Bank of Hawaii (BOH)

The Bank of Hawaii (NYSE:BOH) navigates a menacing storm in the face of a turbulent financial environment. Despite its relatively attractive valuation and dividend profile, the bank’s performance tells an entirely different story. It’s akin to “catching a falling knife,” a risky proposition for investors that could potentially lead to massive losses. BOH’s consistent underperformance compared to its sector peers and poor price performance paints a sordid picture for its future.

The bank’s first-quarter earnings report further highlights these challenges. Both its top and bottom lines missed their marks by a considerable margin. Moreover, while BOH’s diversified deposit base provided a degree of a buffer, more was needed to counterbalance these setbacks. Moreover, amid the banking crisis, the government’s stance is clear in choosing depositors over shareholders. However, as more banks teeter on the brink of failure, it’s becoming increasingly apparent that not everyone can be saved. Given these steep risks, BOH is a stock to sell.

Community Bank Systems, Inc. (CBU)

Community Bank Systems, Inc. (NYSE:CBU) is a popular regional bank headquartered in New York, serving its customers for over 150 years. Despite its stellar deposit franchise and fee-generating non-banking businesses, its growth prospects have already been factored into its lofty share price. It currently trades at almost four times forward sales estimates, almost 91% higher than the sector median.

Unfortunately for the firm, revenue growth has slowed substantially, with net interest income weakening than expected. Moreover, the bank’s non-spread income, a significant contributor to earnings, has been severely impacted by weaker equity markets. Though its credit quality is more in tune with the market, its loan growth and yield expansion have been modest. Some would look at its relatively attractive dividend yield of more than 3.5%, but if you factor in its lackluster 5-year dividend growth rates at just 5.5%, you’re likely to be disappointed.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.