Spirit Airlines Inc.’s stock

SAVE,

tumbled 4% in premarket trade Wednesday, after the discount carrier lowered its third-quarter guidance to reflect increased promotional activity for travel in the second half and aa recent spike in fuel prices. “During the last few weeks, the company has seen heightened promotional activity with steep discounting for travel booked for the second half of the third quarter through the pre-Thanksgiving travel period,” Spirit said in a regulatory filing. The airline is now expecting third-quarter revenue to range from $1.245 billion to $1.255 billion, down from prior guidance of $1.300 billion to $1.320 billion. It expects fuel cost per gallon of $3.06, up from prior guidance of $2.80. The company expects available seat miles to rise 13.4%, down from guidance of 13.7% previously. The news comes as JetBlue Airways Corp.

JBLU,

makes concessions to attempt to get its mooted merger with Spirit back on regulatory track. Spirit’s stock has fallen 11% in the year to date, while the U.S. Global JETS ETF

JETS,

has gained 8% and the S&P 500

SPX,

has gained 16.2%.

7 Promising Blue-Chip Bargains for Long-Term Growth

Blue-Chip bargains are a sure way to add value to your portfolio.

During high market volatility and uncertainty, identifying sound investment opportunities for long-term growth is akin to finding a pearl at the bottom of a waterfall.

However, the bottom contains not one but seven such pearls in the form of Blue-Chip bargains poised for remarkable expansion.

From semiconductor pioneers to tech giants, digital payment leaders, and global banking stalwarts, these companies have honed their strategies to harness the winds of change and secure their positions in an uncertain future.

These industry titans have navigated diverse sectors, from advanced technology to e-commerce, fast food, and finance, all to deliver sustained value to investors.

The article offers insights into how these blue-chip bargains are charting paths to success amid the challenges and opportunities of today’s dynamic market.

ON Semiconductor (ON)

The American semiconductor supplier ON Semiconductor (NASDAQ:ON) has achieved rapid long-term growth through several fundamental strategies.

The company has displayed disciplined and reliable execution, consistently exceeding its targets even in challenging market environments. This approach has resulted in substantial financial performance, with Q2 revenue of $2.09 billion and non-GAAP gross margins of 47.4%.

ON Semiconductor has successfully expanded its silicon carbide business, a key growth driver. Silicon carbide revenue grew nearly 4x YoY.

The company has secured significant long-term supply agreements, with over $11 billion in committed silicon carbide revenue. Partnerships with industry leaders like Vitesco and BorgWarner further solidify its position in the electric vehicle market.

The company’s focus on the automotive and industrial markets, which account for 80% of its revenue, has contributed to its growth.

ON Semiconductor’s advanced sensing technologies, like eight-megapixel image sensors, have gained traction in the automotive sector. Thus, the industrial segment benefits from having a renewable energy infrastructure.

Finally, efforts to streamline operations and exit non-core businesses have improved profitability, and strategic investments in silicon carbide production have yielded results, contributing to gross margin expansion.

The company’s commitment to returning 50% of free cash flow to shareholders enhances investor value.

Intel (INTC)

Intel (NASDAQ:INTC) has outlined several key strategies for achieving long-term growth. One of the key drivers of growth is their focus on artificial intelligence.

They see AI as one of their “5 superpowers” and are actively working to democratize AI by scaling it. Intel also makes AI ubiquitous across various workloads and usage models, from cloud to enterprise, network, edge, and client applications.

This commitment to AI should capitalize on the growing demand for AI products and services, positioning Intel as a leader.

Notably, Intel is also expanding its manufacturing capacity and capabilities. They are investing in leading-edge semiconductor facilities in Germany and plan a new assembly and test facility in Poland.

These investments are part of their IDM 2.0 (Integrated Device Manufacturing) strategy, which aims to strengthen its position in the semiconductor industry and enhance its foundry business.

Intel Foundry Services is another growth driver. It enables Intel to capitalize on the AI market and secure a diversified and resilient global supply chain. IFS expands its scale and accelerates its capabilities at the leading edge, offering choice and leading-edge capacity outside of Asia.

Finally, Intel continues to focus on its product roadmaps with advancements in manufacturing technologies and product offerings, such as the upcoming Meteor Lake platform built on Intel 4 and dedicated AI capabilities to regain its leadership.

Alibaba (BABA)

Alibaba (NYSE:BABA) focuses on providing a superior user experience.

The Taobao app has seen significant growth in its user base, with daily active users increasing by 6% or more YoY. This growth indicates a strong user preference for Alibaba’s platform.

Alibaba is focused on offering value for money to users and merchants. They are onboarding new merchants and encouraging them to participate in the value-for-money battle. This approach is aimed at attracting more users and building long-term merchant relationships.

Strategically, Alibaba invests heavily in AI to enhance merchant tools and improve the shopping experience. They aim to become a one-stop smart portal for life and consumption enabled by AI, catering to the diverse needs of their vast user base.

Moreover, Alibaba International Digital Commerce Group has achieved significant revenue growth, especially in its international retail business, expanding into high-priority markets and improving monetization to drive profitability.

Alibaba is focusing on local services and logistics, with a strong emphasis on improving efficiency. They aim to build a robust logistic network for cross-border and domestic parcels, reducing costs and improving service levels.

Finally, they aim to provide high-performance, low-cost computing power for model training and services, benefiting from the application of AI in all industries.

Apple (AAPL)

Apple (NASDAQ:AAPL) continues to diversify its product lineup.

While the iPhone remains a significant contributor, the company has expanded into various product categories, such as Mac, iPad, wearables, and home accessories. This diversification minimizes dependence on a single product category.

Apple’s rapid growth extends beyond the United States. It has strong sales performance in emerging markets like India, Indonesia, Mexico, and the Philippines. This global presence mitigates the risks associated with regional economic fluctuations.

Apple’s services segment, including the App Store, Apple Music, and Apple TV+, has seen impressive growth. The company’s commitment to expanding its service ecosystem and a growing user base of over 2 billion active devices contributes significantly to long-term revenue. Apple continually invests in product innovation.

Specifically, the transition to Apple silicon for Macs and introducing new features like the Always-On display and advanced iPhone camera systems show the company’s dedication to enhancing its product offerings.

Apple enjoys an exceptionally high level of customer satisfaction and loyalty. This loyalty leads to repeat purchases and a robust ecosystem lock-in, ensuring a steady customer base over the long term.

Notably, Apple is increasingly penetrating the enterprise market, attracting corporate customers with its products, including MacBooks and iPads. This expansion diversifies its revenue streams.

Therefore, Apple’s dedication to accessibility features, user privacy, and security aligns with evolving consumer expectations and regulatory trends and positions the company as a trusted tech provider.

McDonald’s (MCD)

McDonald’s (NYSE:MCD) is rapidly digitizing its operations, with about 90% of business in China coming through digital channels.

The company is leveraging data and technology to enhance customer experiences, streamline operations, and gain insights for future growth.

McDonald’s is opening new restaurants, particularly in major markets. Meanwhile, it also explores innovative formats like takeaway-only locations and food lockers to cater to evolving customer preferences.

Introducing popular items like the McSmart menu in Germany and Saver Meal deals in the UK demonstrates a commitment to adapting to changing consumer needs and providing affordable options.

McDonald’s is investing in its chicken portfolio. The company is introducing products like the McCrispy Chicken Sandwich, which has already scaled to over ten major markets, including Spain, driving significant chicken share gains.

Also, the company’s loyalty programs and mobile app have resulted in digital sales representing nearly 40% of system-wide sales in top markets, with over 52 million active loyalty members.

Finally, McDonald’s has successfully created viral marketing phenomena like Grimace and campaigns rooted in consumer insights, which leads to double-digit solid comparable sales growth.

McDonald’s is also actively testing new concepts like CosMc’s, a small-format restaurant, to diversify its offerings and appeal to different customer segments.

PayPal (PYPL)

PayPal (NASDAQ:PYPL) has benefited from the steady growth of e-commerce, which has remained stable in the mid-single digits and even accelerated in recent months.

As a leading digital payment provider, PayPal’s fortunes are tied to the e-commerce industry, and any uptick in e-commerce spending directly contributes to its growth.

The company has experienced growth in its branded checkout volumes, which is a critical area of focus. In June and July, branded checkout volume growth accelerated significantly, suggesting that PayPal’s strategic initiatives in this area are gaining traction and driving growth.

PayPal has disciplined its operating expenses, leading to an 11% reduction in non-GAAP non-transaction-related expenses YoY. This cost management has contributed to an increase in the non-GAAP operating margin, up approximately 2.3% YoY.

The company’s three strategic priorities—branded checkout, merchant solutions, and digital wallets—have driven growth.

PayPal’s focus on innovation, scaling A/B testing, and improving time-to-market has resulted in consistent product deliveries that enhance the customer experience.

Further, PayPal is investing in AI and machine learning technologies to improve its processes, infrastructure, and product quality. These investments will lead to cost savings and enhanced customer experiences, reinforcing long-term growth prospects.

Citigroup (C)

Citigroup (NYSE:C) has diversified its business model and maintained a strong balance sheet.

This diversification has allowed them to weather challenging macroeconomic conditions in different markets. They have also focused on executing their strategy and simplifying and modernizing their bank. It is ensuring they remain agile and adaptable to changing market conditions.

In terms of revenue growth, Citigroup has seen success in various segments. Their Treasury and Trade Solutions business has experienced substantial growth, with revenues up 15% YoY.

This growth is driven by net interest and non-interest revenue as Citigroup wins fee-generating mandates with new clients and deepens relationships with existing corporate and commercial clients.

Security services revenues have increased by 15%, driven by higher interest rates across currencies.

Citigroup’s focus on cost efficiency is evident in its commitment to bending the expense curve by the end of 2024.

They are pursuing cost-saving opportunities to offset significant investments in their transformation, simplification efforts, and technology enhancements.

In their Personal Banking and Wealth Management business, Citigroup has seen growth in branded cards, retail services, and Wealth at Work.

New client acquisition in the private bank and wealth at work has grown significantly due to investments in their client advisors and bankers network.

While they faced challenges in investment banking, particularly in Q2 2023, Citigroup focused on right-sizing the business and making strategic investments in areas like technology and healthcare.

As of this writing, Yiannis Zourmpanos held a long position in INTC, BABA, PYPL and C. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Uh-Oh! Don’t Let EVGO Stock Short-Circuit Your Portfolio.

Source: Sundry Photography / Shutterstock.com

Previously, we gave EVgo (NASDAQ:EVGO) stock a “D” grade along with a warning for prospective shareholders. Now, even as we uncover more information and developments, we still can’t enthusiastically recommend investing in EVgo.

Maybe you’re intrigued with EVgo because you envision vigorous growth in the electric vehicle (EV) charging market. Your optimism is understandable, but EVgo has problems from a financial perspective.

The company’s long-term investors are holding a heavy bag which, for all we know, might get a lot heavier.

Is EVGO Stock Headed for $9?

Speaking of heavy bags to hold, EVGO stock has been like a tire slowly running out of air during the past three years. Sure, there have been share-price pops along the way, but they’ve all been short-lived.

There is at least one analyst that seems to favor EVgo. Or maybe we should say, the analyst favors the EV-charging market generally, and EVgo could benefit from that market’s expected growth.

Here’s the scoop. Recently, RBC analyst Chris Dendrinos reportedly issued a $9 price target on EVGO stock. Dendrinos sees “positive secular trends in vehicle electrification and growing demand for charging infrastructure.”

According to Barron’s, Dendrinos expects the “number of U.S. charging ports” to increase from “roughly 1 million today to more than 30 million by the end of the decade.” That’s fine, but is the analyst’s price target realistic?

If EVGO stock is trading at $3 and change as of this writing, then $9 is quite an ambitious price objective. Even with industry-wide tailwinds, there’s a limit to how much EVgo’s market capitalization can realistically grow during the next 12 months.

EVgo Is Ambitious but Far From Profitable

Don’t get the wrong idea here. For all we know, the EVgo share price might zoom to $9. But again, look at the stock’s past performance and then form your own conclusion.

While you’re conducting your due diligence, be sure to check EVgo’s financial figures. There’s no denying that EVgo’s second-quarter 2023 revenue increased substantially on a year-over-year basis. Based on that, EVGO stock might deserve a “D” grade instead of an outright “F.”

Revenue is only part of a company’s full fiscal picture, though. In Q2 of 2023, EVgo sustained a net earnings loss of $21.539 million. That’s a deep decline, as EVgo actually reported income (as opposed to a loss) totaling $16.997 million in the year-earlier quarter.

Another issue to contend with is EVgo’s chief executive transition. The company will have a new CEO in November, so this might not be the ideal time to wager your hard-earned capital on EVGO stock.

Don’t Get All Charged Up About EVGO Stock

Nothing is impossible on Wall Street, and the EVgo share price might catapult to $9. But ask yourself: Is the risk-to-reward scenario favorable if I invest in EVgo now? Or, could I end up holding the bag, like other long-term shareholders ended up doing?

Just because the EV charging industry could grow over the coming years, doesn’t mean EVgo will return to profitability anytime soon. Therefore, EVGO stock doesn’t earn a must-own recommendation from us, and we’re sticking to our “D” grade on it today.

On the date of publication, neither Louis Navellier nor the InvestorPlace Research Staff member primarily responsible for this article held (either directly or indirectly) any positions in the securities mentioned in this article.

The 7 Most Undervalued Dividend Stocks With Growth Potential

Some of the best opportunities can be found in undervalued dividend stocks with growth potential. In fact, I found seven of them which have at least 2% dividend yields with relatively low valuations, and solid growth prospects ahead of them. Some of the top ones include:

Undervalued Dividend Stocks with Growth Potential: IBM (IBM)

Source: shutterstock.com/LCV

IBM (NYSE:IBM) is making major strides in artificial intelligence and the cloud. In fact, according to research firm Melius Research found that many companies would engage IBM’s AI consultants. Melius also believes that Big Blue can beat the Street’s forecast of just 3% top-line growth in 2024. The firm has a $175 price target and a “buy” rating on the shares.

In addition, as I pointed out in a prior column, the company’s AI software platform was “adopted by over 150 organizations,” including Citi and Samsung. All “just ten days after being launched.”

In the cloud, the revenue of its subsidiary, Red Hat, jumped an impressive 11% last quarter versus the same period a year earlier. Finally, IBM expects to generate $10.5 billion of free cash flow in Q3. IBM stock has a low forward price-earnings ratio of 14.5 and a high dividend yield of 4.5%.

AT&T (T)

Source: Bro Crock / Shutterstock.com

Last month, Citi raised its rating on AT&T (NYSE:T) to a buy rating, citing, “the stabilization of competition in the wireless sector, an attractive valuation, and improving free cash flows.’”

In addition, much like its competitor, Verizon (NYSE:VZ), AT&T will benefit from the $42 billion that the Biden Administration will invest to make Internet access universal over the next few years. AT&T, like Verizon, should gain many more broadband customers from that initiative. Better, CSCO trades at 5.8x forward earnings, with a yield of 2.77%.

Undervalued Dividend Stocks with Growth Potential: Broadcom (AVGO)

Source: Sasima / Shutterstock.com

Broadcom (NASDAQ:AVGO) is benefiting from the advent of artificial intelligence. In fact, the company just reported that its AI-related sales helped the firm increase its overall revenue by 5% last quarter versus the same period a year earlier.

In response to the company’s quarterly results, Bank of America maintained its “buy” rating on the shares. Meanwhile, BMO Capital increased its price target on the name to $1,000. In addition, Broadcom is in the final stages of acquiring VMware, a leading developer of cloud technologies for data centers. With data centers poised to rapidly grow due to the proliferation of AI, the acquisition should significantly lift AVGO stock over the longer term.

AVGO stock has a fairly low forward price-earnings ratio of 18.9 and a yield of 2.14%.

Goldman Sachs (GS)

Source: rafapress / Shutterstock.com

Goldman Sachs (NYSE:GS) is poised to get a big lift from the improved performance of U.S. stock markets and the revitalization of the IPO market. In fact, if chip maker ARM Holdings and delivery service Instacart perform well out of the gate, we could see even more IPOs. All of which could be a substantial benefit to firms like Goldman Sachs.

Helping, analysts at HSBC recently identified GS stock as a top pick, citing its ability to get a lift from a rebound of the entire investment banking sector. HSBC expects GS to generate revenue growth of around 10% next year, along with ” outsized EPS growth in both 2024 and 2025.” GS stock has a very low forward price-earnings ratio of just 8.6 and a high dividend yield of 3.4%.

Cisco (CSCO)

Source: Valeriya Zankovych / Shutterstock.com

Cisco (NASDAQ:CSCO) just reported strong fiscal fourth-quarter results. Its top line number was up 16% year over year to $15.2 billion. Meanwhile, EPS soared about 37% year over year $1.14. “We are seeing solid customer demand, gaining market share, and innovating in key areas like AI, security, and cloud,” said CEO Chuck Robbins in a statement. Even better, for all of its current fiscal year, CSCO expects its EPS to come in between $4.01 and $4.08. That puts its forward price-earnings ratio at a low 14. The shares have a dividend yield of 2.77%.

Bank of America (BAC)

Source: PopTika/ShutterStock.com

HSBC recently identified Bank of America as one of its “top picks” among large U.S. banks, giving it a buy rating to boot. Even better, HSBC was upbeat on BAC’s valuation, noting, “We believe Bank of America’s considerable scale, capacity to invest vast sums on technology and innovation, broad product depth, and well-known brand provide considerable advantages across its business.”

In a previous column, I noted that I expect BAC to benefit from upcoming interest rate cuts and pointed out that Warren Buffett has maintained his large stake in BAC stock. BAC also trades at 8.5x forward earnings, with a yield of 3.31%.

NextEra (NEE)

Source: madamF / Shutterstock.com

Elon Musk recently predicted that electricity demand would soar in the U.S. thanks to the proliferation of electric vehicles and AI. In fact, Musk predicts that the U.S. will suffer an electricity shortage in 2025. NextEra (NYSE:NEE), which owns America’s largest electric utility, should benefit from that trend.

Further, as I pointed out in a previous column, “NEE’s net income jumped nearly 100% last quarter, reaching $2.8 billion, versus $1.38 billion during the same period a year earlier. Amazingly, the net income of the company’s renewable energy unit soared over 10 times versus the same period a year earlier to $1.46 billion.”

On the date of publication, Larry Ramer’s wife held a long position in BAC. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Do You Have to Close an Options Calendar Trade?

The 3 Most Undervalued Biotech Stocks to Buy in September 2023

It’s been a difficult time for biotechnology stocks. After a boom during the Covid-19 pandemic, the entire sector appears to have been abandoned by investors. The Standards and Practices (S&P) 500 Biotechnology Select Industry Index has declined 11% throughout the past 12 months and is down 18% throughout the last five years. Companies large and small have seen their stock prices slump as investor confidence in the industry wanes. Of course, hurdles surrounding prescription drug makers and medical treatments are legendary. Having said that, there are still some undervalued biotech stocks that you should consider.

Huge capital outlays, years of research, regulatory hurdles, rampant competition and the ever-present threat of losing patent exclusivity loom over the entire industry. This is leading many investors to steer clear of it altogether. However, there are some hidden gems to be found among biotech stocks. The downturn has left many companies with extremely attractive valuations. Here are the three most undervalued biotech stocks to buy in September 2023.

Moderna (MRNA)

Biopharmaceutical company Moderna (NASDAQ:MRNA) has suffered a big comedown throughout the last two years. The company’s share price is currently down 41% this year and 77% below its all-time high reached in September 2021. The company’s Covid-19 vaccine was one of the first approved by the U.S. Food and Drug Administration (FDA). It was a global hit and generated sales of $18.4 billion last year, but those sales are projected to fall to $5 billion this year. This is sending MRNA stock sharply lower as a result.

The other issue pulling MRNA stock lower is the fact that its pipeline has not produced any other commercially available medications. While the company has several new prescription drugs in development, its Covid-19 vaccine is currently the only product generating any revenue. However, there is some hope of an upsurge in Covid-19 vaccine sales this fall and winter. This is particularly true as people get boosted against the respiratory illness. Moderna currently has $14.6 billion of cash on its balance sheet, putting it in a strong position.

Amgen (AMGN)

Shares of Amgen (NASDAQ:AMGN) have generated no gains this year. The company’s stock is up less than 1% since January. Over five years, the shares have risen a middling 30%. It is trading at 17 times future earnings and is offering shareholders a quarterly dividend of $2.13 per share, for a yield of 3.25%. AMGN stock looks undervalued at current levels. Amgen specializes in medications that treat autoimmune diseases such as rheumatoid arthritis and drugs that prevent infections. Amgen is one of the biggest independent biotech companies in the world.

The stock has been held back by its $27.8 billion acquisition of Horizon Therapeutics (NASDAQ:HZNP). This deal will give Amgen access to blockbuster medications such as thyroid eye disease treatment Tepezza and gout drug Krystexxa. However, this has drawn close scrutiny from regulators. Once the Horizon takeover is completed, it should provide Amgen with plenty of growth opportunities and light a fuse under the share price. Amgen also has a strong pipeline with more than 40 products in differing stages of clinical development. This is one of the most undervalued biotech stocks.

Pfizer (PFE)

Shares of Pfizer (NYSE:PFE) looks dirt cheap right now. The biotech company’s stock is currently sitting at a 52-week low and down 34% year to date. Through five years, the share price has declined 17%. Right now, PFE stock is trading at a rock bottom nine times future earnings, and it provides a dividend of 41 cents a share, for a yield of nearly 5%. Among biotechnology companies, few if any look as undervalued as Pfizer, whose share price has crumbled following its second-quarter financial results being made public.

For Q2 of this year, Pfizer reported a 54% year-over-year decline in its revenue due mainly to dwindling sales of its Covid-19 vaccine. Sales of Pfizer’s Covid-19 shot fell 83% to $1.49 billion during Q2. The company said it is in a “transition period” as it navigates its post-pandemic sales boom, and said it is considering widespread cost cuts in the coming months. However, Pfizer too has other commercial products and a strong pipeline of new medications that it says should help it find new areas for growth.

On the date of publication, Joel Baglole did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

7 Stocks to Sell Based on Unusual Options Activity

While no participating entity in the capital markets is infallible, retail investors may nevertheless find comfort in targeting opportunities – or exiting from them as is the case here – based on unusual options activity. For this edition, we’ll be exploring stocks to sell based on the rumblings printed by the so-called smart money.

To lay the framework for understanding unusual options activity, we must appreciate the concept of implied volatility (IV). Think of IV as the scouting report of a baseball prospect. By itself, a scouting report doesn’t guarantee that the targeted player will pan out. However, it does suggest heightened interest. So, if a team wants to pick up the prospect, it will have to fork over a higher premium.

On the other hand, an established star player may command so much value that a team seeking to fill gaps in its organization may want to sell or trade said player. In this case, a team may believe the athlete’s best days are behind him. Understanding the possible motivations behind unusual options activity can help you make data-driven decisions. With that, these may be the stocks to sell based on peculiar derivatives trading dynamics.

Vita Coco (COCO)

At first glance, Vita Coco (NASDAQ:COCO) does not seem like a natural candidate for stocks to sell for any reason. Since the beginning of the year, shares have more than doubled in value. However, COCO offers an excellent example of letting the data guide your decision-making process.

Yes, COCO has performed very well. But recently, in Barchart’s screener for unusual stock options volume, trading volume for puts heavily outweighed calls. To be clear, that by itself doesn’t mean much since selling options generally features the opposite sentiment of buying them. Still, a closer investigation of its volatility smile warrants caution.

A volatility smile plots IV at various strike prices. Conspicuously for COCO, IV is much higher for the deep in-the-money direction – that is, the lower strike prices – than it is for the far out-the-money (OTM) direction. Technically, it appears that traders are hedging for significant downside risk.

In the near term, options flow data – which filters for big block trades likely made by institutions – point to heavy sold call volume. Thus, COCO might be a name to avoid based on unusual options activity.

Digital Realty Trust (DLR)

Another entity that seemingly doesn’t appear to rank among stocks to sell, Digital Realty Trust (NYSE:DLR) is a real estate investment trust that owns, operates, and invests in carrier-neutral data centers across the world. Since the beginning of this year, DLR has gained over 20% of its equity value. And it’s been flying in the trailing six months.

However, the unusual options activity in DLR warrants serious caution. Per Fintel, Digital Realty’s volatility smile shows IV spiking higher in the deep ITM direction. In fairness, IV also rises in the far OTM direction too. Nevertheless, the delta in magnitude is gargantuan, possibly indicating that traders are mitigating tail risk (i.e. black swan event).

Most problematic in my opinion is that institutional traders appear to have bought $85 puts. Given the high IV of low-strike-price puts, traders are incentivized to sell the puts, not buy them. Think of a terrible organization like the Los Angeles Angels keeping Shohei Ohtani instead of trading him for multiple prospects.

In this case, the smart money seems convinced that DLR will fall. Therefore, I’d stay away.

Toll Brothers (TOL)

Another top-flight enterprise, homebuilder Toll Brothers (NYSE:TOL) presents a more understandable case for stocks to sell. With inflation remaining stubbornly high, fewer folks are able to afford residential real estate. Adding to the misery, the spike in borrowing costs from lifted interest rates imposes affordability woes. Unsurprisingly, TOL incurred unusual options activity.

To be sure, Toll Brothers’ volatility smile is quite telling. Yes, IV does rise higher in the extremities of far OTM strike prices. However, in the deep ITM direction, the IV lift is quite conspicuous. While I can’t make any guarantees, it appears that the smart money is protecting against both realistic downside possibilities as well as outright tail risk.

Also, what’s truly problematic is that in recent sessions, options flow data shows heavy volume for transactions that have bearish implications. To me what’s alarming is the acquisition of $60 puts with an expiration date of Dec. 15, 2023. These puts have high IV relative to the far OTM options. Thus, the incentive is to sell. That institutional investors are buying the puts suggests a high conviction of incoming downside.

PNC Financial (PNC)

Occupying the gap between a true regional and national bank, PNC Financial (NYSE:PNC) represents one of the stocks to sell that’s not so surprising to see on this list. Of course, earlier this year, the regional banking crisis sent a shockwave to the system. And questions still linger about broader stability in the sector.

Still, when looking at the underlying options dynamic, one can’t help but feel a little bit concerned. For one thing, PNC’s volatility smile shows heightened IV at both ends of the pricing extreme. However, the magnitude of IV is far higher at the lower strike price range compared to the countervailing range. Therefore, you’d expect – all other things being equal – for the smart money to sell options rather than buy them.

However, the most recent transaction in PNC’s options flow screener shows an acquisition of puts, specifically the $123 puts which expire on Oct. 6 of this year. That might be a high-conviction negative trade as again, the incentive really is to sell derivative contracts. Thus, PNC should be on your watch list based on unusual options activity.

VMware (VMW)

An American cloud computing and virtualization technology firm, VMware (NYSE:VMW) is an intriguing enterprise. At the same time, the tech sector overall has been rather unpredictable, raising the specter of stocks to sell. However, VMW easily defied gravity, gaining over 35% since the start of the year. In the past 365 days, it’s up almost 40%.

Still, it’s not out of the realm of possibility for VMware to suffer a shift in sentiment. Looking at its volatility smile, the underlying IV trend is all over the map. Still, the main takeaway is that IV is generally elevated at the strike price extremes. However, the magnitude of moving toward the deep ITM direction implies risk mitigation among smart money traders.

Further, even with IV elevated, institutional investors appear to be buying put options. Specifically, big block trades have been place for $110 puts with an expiration of Jan. 19, 2024. Per Fintel, the IV for this contract is much more elevated than usual at 1.8. Nevertheless, the institutions are buying the puts, not selling them and collecting the premium. It’s possible we could have another high-conviction pessimistic trade, making VMW another one to watch based on unusual options activity.

American Eagle Outfitters (AEO)

At first blush, American Eagle Outfitters (NYSE:AEO) doesn’t seem like an enterprise to sell. It’s been one of the strong performers recently, with shares up over 24% in the trailing six months. Since the beginning of the year, AEO returned just under 10%. However, the questions about the viability of the consumer economy cast a cloud over the fashion apparel retailer.

Turning to its volatility smile, IV gradually rises in the far OTM direction, which is perfectly normal. However, IV veritably skyrockets in the deep ITM direction, posing concerns for would-be speculators in the open market. Basically, it seems that smart money recognizes the extreme volatility risk of AEO. That’s not shocking considering that in the trailing five years, shares tumbled nearly 36%.

However, what’s really eye-opening is that throughout this month, options flow data shows significant volume for bought puts at various strike prices. Again, with IV elevated at the extremes, the pros would be incentivized to sell options. Naturally, the buying of puts (an unusual options activity) makes AEO questionable.

Abercrombie & Fitch (ANF)

Perhaps one of the most intriguing ideas to red flag based on unusual options activity, apparel retailer Abercrombie & Fitch (NYSE:ANF) has enjoyed enormous success this year. Since the beginning of this year, ANF shot up over 126%. In the trailing one-year period, shares returned nearly 222%. At first glance, it’s not the type of idea that belongs on a list of stocks to sell.

However, it’s always possible that sentiment can shift, especially as prolonged pressures like inflation weigh on discretionary consumer spending. Still, ANF’s volatility smile offers a fairly wild profile. Toward the far OTM direction, IV peaks at 0.65 at the $80 strike price. On the flip side, toward the deep ITM direction, IV clocks in at 0.75 at the $35 strike.

It’s possible that the smart money recognizes both ANF’s upside potential (as evidenced by its strong showing this year) as well as its downside risk. Interestingly, the most recent entry in ANF’s options flow screener was for the sale of $55 calls expiring on Sept. 15. Ultimately, with the security having jumped so high, it might be more prudent to trim exposure.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

7 Dividend Aristocrats Sporting the Highest Yields

History proves there is no better way to create generational wealth than buying dividend stocks — especially the Dividend Aristocrats. There has not been a single decade over the last 93 years where dividend-paying stocks on the S&P 500 did not outperform non-dividend stocks.

More recently, JPMorgan Chase found stocks that initiated and then raised their payouts over the 40-year period between 1972 and 2012 returned an average of 9.5% annually, versus just 1.6% non-dividend-paying stocks.

That’s why you should buy Dividend Aristocrats. These are stocks that are part of the S&P 500 that have raised their dividends every single year for at least 25 years. It’s a surprisingly select group of companies. Only 67 stocks make the cut. Simply chasing yield is a dangerous pursuit since a higher yield often entails higher risk. So, ideally, you want to balance the yield with risk. Fortunately, Dividend Aristocrats tend to do that, even if it’s not a foolproof strategy.

For example, AT&T was booted from the list last year after cutting its payout in half following the spinoff of its Warner Media business. The deal, though, actually strengthened the telecom’s remaining dividend payment and may give AT&T a chance to grow again.

So let’s look at each of these high-yielding Dividend Aristocrats.

Dividend Aristocrats: IBM (IBM)

Source: shutterstock.com/LCV

IBM (NYSE:IBM) is a highly profitable business that essentially created the information technology industry. Yet it has been too late to recognize today’s leading tech trends. For example, it missed the transition to cloud computing and scrambled to become a hybrid cloud company offering both physical and cloud-based solutions. There’s potential in the field, but IBM is not the leader.

In fact, a lot of IBM’s offerings reek of a “me too” strategy. It gloms onto whatever is popular at the moment without putting any distinctive IBM imprimatur on it. But its operations do throw off a lot of cash. Trailing 12-month free cash flow stands at $10.3 billion. While that’s less than a few years ago, it’s more than in 2022, and it handily supports its dividend that yields 4.5% annually. IBM has increased its dividend for 30 straight years.

Franklin Resources (BEN)

Source: Dmitry Lobanov/Shutterstock.com

Best known as the owner of Franklin Templeton, one of the world’s largest investment managers with $1.4 trillion in assets under management (AUM), Franklin Resources (NYSE:BEN) is benefiting from an improving market. AUM increased in the latest period while outflows stabilized and remained flat.

The asset manager suffered from strong long-term net outflows earlier this year as consumer confidence in the economy wavered. Since much of Franklin’s revenue is dependent upon investment management fees, market volatility can work for the company as well as against it. A heady feeling amongst investors gets them to put money into the market, boosting AUM. Angst over the economy’s direction has them pulling money out. But bull markets always follow bears, and the long-term directory for this premiere asset manager is up.

Franklin Resources is seeking new lines of business to diversify. It recently acquired a retirement asset business; a credit and private debt manager; and additional real estate, private credit, and hedge fund lines. The firm has raised its dividend for 41 years and counting. The payout yields 4.6% annually.

Amcor (AMCR)

Source: Shutterstock

There’s a good chance you’ve never heard of Amcor (NYSE:AMCR). Involved in the packaging industry for food, beverages, pharmaceuticals, and personal care products, its business is suffering as a result of persistent high inflation and continued rising food costs. Consumers are not buying the same kinds of foods they were previously. Or, they’re cutting back, as pocketbooks are hit hard.

Amcor is being hit with high raw material costs as well. That led the packaging expert to raise prices where it could to offset the impact. It resulted in growing adjusted operating earnings for the year. The company has been through these business cycles before and weathered them just fine. Its dividend is stellar too. Amcor has raised its dividend for 40 consecutive years and yields 5.4%. Over the past three years, the payout has risen at an average rate of 27% annually.

Realty Income (O)

Source: Shutterstock

Real estate investment trust Realty Income (NYSE:O) is a unique Dividend Aristocrat in that it makes its payout monthly. In fact, it dubbed itself “The Monthly Dividend Company.” It’s not the only REIT to pay dividends every 30 days, but it’s done it the longest. Better, the REIT has now declared 638 consecutive monthly dividends and increased the payout 121 times. The dividend yields 5.6%.

It owns more than 13,100 real estate properties. The commercial tenants occupying its space do so under long-term net lease agreements. It also just agreed to buy Blackstone‘s 22% stake in the Bellagio casino in Las Vegas for $300 million. Realty Income will also contribute $650 million in preferred equity into the venture with Blackstone. Las Vegas is making a strong comeback and Realty Income’s investment should help it benefit from the new relationship.

3M (MMM)

Source: JPstock / Shutterstock.com

Although 3M (NYSE:MMM) was well-known previously for products like Post-It Notes and Scotch brand tape, the industrial conglomerate really gained consumer mindshare during the pandemic. Everyone wanted one of its N95 masks for protection and they were in short supply.

With the situation normalized once more, 3M’s stock is now under pressure from potential legal liabilities related to contaminated drinking water and faulty earplugs for the military that were manufactured by a company it acquired. It agreed to pay out $10.3 billion for the so-called “forever chemicals” found in the water, and it has set aside up to $1 billion for claims on the earplugs. Some analysts, though, think that might not be nearly enough.

Despite the headwinds, 3M remains exceedingly profitable. Earnings in the second quarter took a hit because of the one-time charges related to the settlement, but it was still able to report adjusted profits of $2.17 per share. While that was down 12% year over year, it includes pre-tax restructuring charges of $0.31 per share.

3M also returned $828 million to shareholders through dividends. The conglomerate has raised its dividend for 66 years running. It yields 5.6% annually.

Leggett & Platt (LEG)

Source: Shutterstock

Like Amcor, many investors may not be familiar with Leggett & Platt (NYSE:LEG) even though they may use its products every day. It’s one of the leading manufacturers of innerspring coils for mattresses and sofas. Leggett & Platt also makes mechanical and lumbar support for car seats, steel mechanisms and motion hardware for chairs, and synthetic fabrics for ground stabilization, drainage protection, erosion, and weed control.

With the housing and auto industries in a weakened state, the diversified manufacturer took a hit to sales. Consumer demand for mattresses, furniture, and flooring were all much less than anticipated in the second quarter resulting in sales falling 8% from last year. It should be noted that last year’s earnings saw sales hit a record $1.33 billion for the period.

Leggett & Platt lowered full-year guidance because of volatility in the marketplace. It also said it did not have much visibility into how long these conditions will last. Housing doesn’t look like it will turn around anytime soon, but the auto industry is seeing some improvement. New car sales surged 15% higher in August compared to last year. Aerospace and hydraulic cylinder segments are also enjoying growth, but they comprise the two smallest businesses Leggett & Pratt operates.

However, investors are sustained by its dividend, which currently yields 6.9%. It’s paid a dividend every year since 1939 and raised it for 52 years straight (also making it a Dividend King).

Walgreens Boots Alliance (WBA)

Source: saaton / Shutterstock.com

The Dividend Aristocrat with the highest dividend yield is Walgreens Boots Alliance (NASDAQ:WBA) at 8.7% as compared to the S&P 500’s 1.5% yield. But Walgreens did something notable this past July that it hasn’t done in the past 47 years: it didn’t raise the payout.

The company’s stated policy is “to increase its dividend each year.” It even points out it has made a payment every quarter since 1933. The inaction indicates the pharmacy chain is hurting. In fact, the CEO quit to kick off September.

Technically, Walgreens just needs to pay out more dividends per share from one year to the next to continue qualifying as a Dividend Aristocrat. That means there is still time to raise it. That it didn’t do so when it normally does is telling. As I said before, Dividend Aristocrats tend to keep raising their payouts, but not always.

Sales were up 9% in the fiscal third quarter and adjusted profits rose 3%. However, declining demand for Covid vaccines caused a 20% headwind. President Biden is requesting funding for a new and improved vaccine, but the public may not line up to take yet another booster shot. Officials, though, want people taking one at least every year.

To contain costs now, Walgreens is targeting $4.1 billion in annual cost savings by the end of fiscal 2024. It is also expanding its focus beyond its pharmacies, moving into primary, specialty, and urgent care. A bet now on Walgreens Boots Alliance is one that sees the pharmacy chain turning it around.

On the date of publication, Rich Duprey held a LONG position in T, BEN, AMCR, O, MMM, LEG, and WBA stock. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Is SPYI the Best High Yield Dividend ETF?

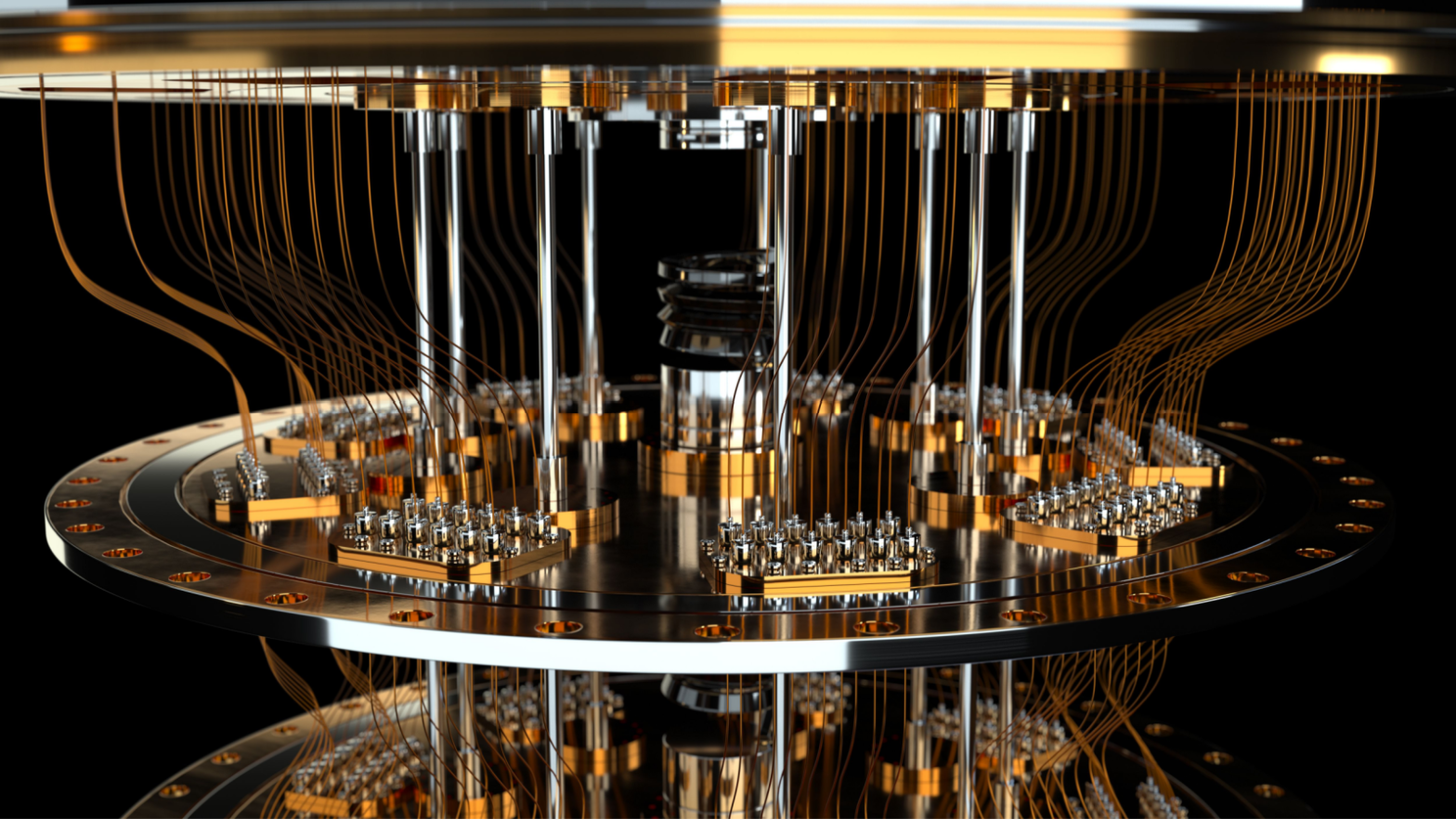

The 3 Most Undervalued Quantum Computing Stocks to Buy in September 2023

If you thought the artificial intelligence boom was explosive, keep an eye on quantum computing.

According to Haim Israel, Head of Global Thematic Investing Research at Bank of America, we could soon see “a revolution for humanity bigger than fire, bigger than the wheel,” as quoted by Barron‘s. This is creating a massive opportunity for quantum computing stocks.

Whereas a supercomputer could take several years to compute, quantum computing can solve in a matter of minutes. In 2019, Google’s quantum computer once performed a calculation in 200 seconds. It would have taken the world’s most powerful computer about 10,000 years to complete this computation.

Another example is drug development.

“It takes an average of 15 years and tens of billions of dollars because only one out of 10,000 molecules becomes a drug. Quantum computing can do those calculations probably in a matter of minutes. I can’t even think about an industry that won’t be revolutionized,” according to Haim Israel in a Barron‘s article.

Or, how about this? A team of scientists in Australia recently used quantum computing to slow down a molecular interaction 100 billion times slower than normal. In doing so, they slowed down chemical dynamics from femtoseconds (a quadrillionth of a second) to milliseconds. At those speeds, we could be looking at massive disruption in nearly every industry in the world.

These facts and stats could mean incredible profits for the following quantum computing stocks.

IonQ (IONQ)

The last time I mentioned IonQ (NYSE:IONQ), the pure-play stock traded at just $4.56 on March 13. Today, it’s up to $19.68 and could see higher highs.

All thanks to a booming quantum computing market and solid earnings growth.

While the company posted a loss of 22 cents a share, missing estimates by 14 cents, revenue more than doubled to $5.52 million. That number beat estimates by $1.16 million. Also, Q2 bookings were a record $28 million, which now brings first-half 2023 bookings to more than $32 million.

In addition, the company increased its 2023 bookings to a new range of $45 million to $55 million. Then it raised full-year revenue guidance to $18.9 million to $19.3 million from a prior range of $18.8 million to $19.2 million. Analysts like the stock, with Morgan Stanley raising its price target to $16 from $7. Even Benchmark raised its target price to $20 from $17.

Rigetti Computing (RGTI)

Also, Rigetti Computing (NASDAQ:RGTI) has been equally as explosive. Since May, the company developing quantum integrated circuits for quantum computers popped from about 36 cents to a high of $3.43. While it has since pulled back to $2.03, recent weakness could be seen as an opportunity.

From current prices, I believe RGTI could double, if not triple, to higher highs. Helping, Benchmark analysts just upgraded RGTI to a “buy” rating, with a price target of $44, all thanks to earnings. In its second quarter, the company posted Q2 EPS of 13 cents, which beat estimates by four cents. Revenue, up 56% year over year (YOY) to $3.33 million, beat by $0.58 million.

Defiance Quantum ETF (QTUM)

Or, if you want to diversify among top quantum computing names at low cost, try an ETF, such as Defiance Quantum ETF (NYSEARCA:QTUM).

With an expense ratio of 0.40%, the fund provides exposure to cloud computing, quantum computing, artificial intelligence, and machine learning stocks. Better, the ETF has been on fire this year. Since January, the ETF ran from about $39 a share to a recent high of $50.15.

From there, I’d like to see QTUM again challenge prior resistance around $53.55. Some top holdings include Ionq, Rigetti Computing , Splunk (NASDAQ:SPLK), Intel (NASDAQ:INTC), Nvidia (NASDAQ:NVDA), and Applied Materials (NASDAQ:AMAT) to name a few of its 71 holdings.

On the date of publication, Ian Cooper did not hold (either directly or indirectly) any positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines