Oil prices finished higher on Friday, with U.S. benchmark crude marking another finish at their highest since November and posting a third straight weekly gain. Warnings by the International Energy Agency and the Organization of the Petroleum Exporting Countries of a “potential market deficit,” have contributed to the rise in oil prices, said Han Tan, chief market analyst at Exinity Group. Although crude prices may be ripe for a technical pullback over the short term, oil benchmarks may yet take further strides towards the psychologically-important $100 level, “provided that global supply-demand dynamics truly warrant prices moving even higher.” October West Texas Intermediate crude

CLV23,

rose 61 cents, or 0.7%, to settle at $90.77 a barrel on the New York Mercantile Exchange. That’s the highest front-month contract finish since Nov. 7, with prices ending the week 3.7% higher, according to Dow Jones Market Data.

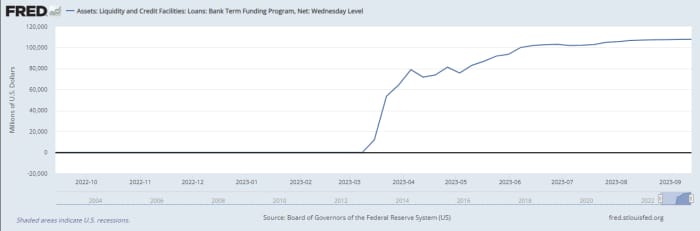

Why an emergency Fed lending program for banks is seeing increased demand

Financial institutions are increasingly taking advantage of an emergency program created by the Federal Reserve in March after the collapse of California’s Silicon Valley Bank.

As of Wednesday, they borrowed almost $108 billion from the Fed’s Bank Term Funding Program, which was designed to provide an additional source of liquidity at times of stress, according to data from the central bank. That’s up by $138 million from the prior week. The increased borrowing occurred during a one-week period in which Treasury yields were not far from some of their highest levels of this year, a sign of diminished demand for underlying government debt.

Source: Federal Reserve Board of Governors

The Fed’s BTFP was created in March as a way to ensure institutions would be able to meet the needs of their depositors, and offers loans of up to one year in exchange for collateral such as Treasurys, plus agency and mortgage-backed securities. The program is intended to eliminate a financial institution’s need to rapidly sell securities, and is open to federally insured banks, savings associations, and credit unions, as well as the U.S. branches of foreign banks.

The Fed announced its Bank Term Funding Program on March 12, the same Sunday when regulators closed New York’s Signature Bank. Two days earlier, Silicon Valley Bank had collapsed after a run on its deposits and a crisis of confidence triggered by the forced sale of a bond portfolio at a $1.8 billion loss.

Now, banks’ use of the emergency BTFP facility “has been creeping up over time” because it offers relatively attractive financing when compared with the Fed’s discount window, said Thomas Simons, a U.S. economist at Jefferies

JEF,

“To the extent that usage continues to climb, it offers proof that banks need that much more liquidity,” Simons said via phone on Friday. “But the increase so far is not enough to signal new problems in the banking system. It’s more indicative of the current state in which deposits are getting more expensive to retain, and banks are trying to manage that.”

As of Friday, investors and traders were looking ahead to next Wednesday’s policy announcement by the Federal Reserve. Treasury yields finished at their highest levels since August, while all three major U.S. stock indexes

DJIA

COMP

were lower in the final hour of trading.

GM, STLA, ADBE, DASH and more

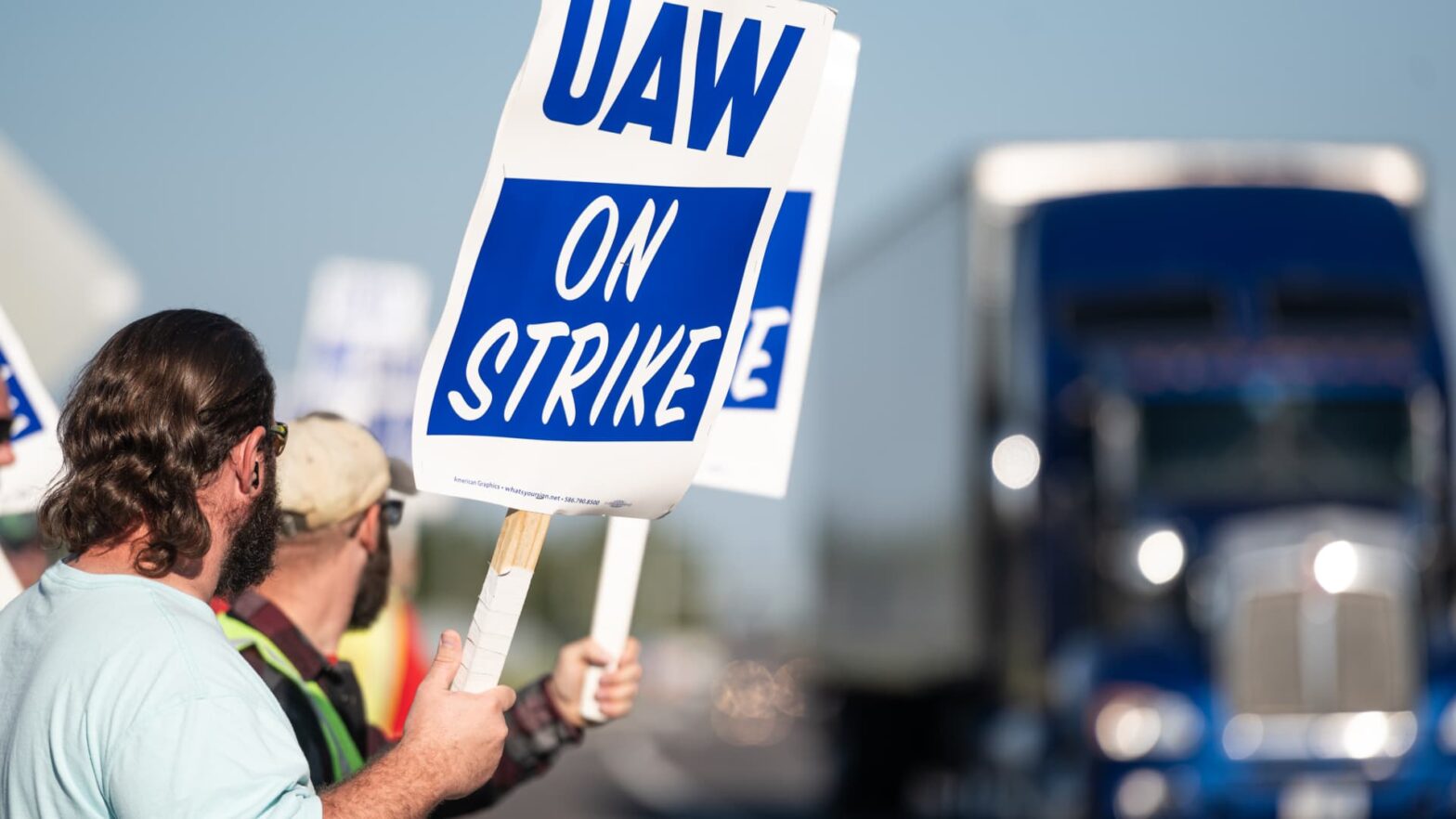

GM workers with the UAW Local 2250 union strike outside the General Motors Wentzville Assembly Plant in Wentzville, Missouri, Sept. 15, 2023.

Michael B. Thomas | Getty Images

Check out the companies making headlines in midday trading.

General Motors, Ford, Stellantis — Shares of Ford rose slightly, while General Motors gained 1% and Stellantis was up 2% as a targeted strike by the United Auto Workers began. Workers walked off the job at several assembly plants belonging to the three automakers Thursday night after a key deadline to settle a new labor contract passed.

Planet Fitness — Shares slid 13% after the gym chain’s board pushed out CEO Chris Rondeau. The move was shocking to employees close to Rondeau, a person familiar with the matter told CNBC. Board member Craig Benson, known for his role as the former governor of New Hampshire, is the interim CEO.

Nucor — The steelmaker fell 5% after offering worse-than-expected guidance for third-quarter earnings, with the company pointing to pricing and volume challenges. Nucor said to expect earnings between $4.10 and $4.20 per share, while analysts polled by LSEG, formerly known as Refinitiv, forecast $4.57.

PTC Therapeutics — The therapeutics stock plummeted 28.3% after the European Medicines Agency’s Committee for Medicinal Products for Human Use issued a negative opinion on a conversion of conditional to full marketing authorization for a PTC drug to treat nonsense mutation Duchenne muscular dystrophy. Raymond James downgraded the stock to underperform from outperform following the news.

Core & Main — The infrastructure stock retreated more than 3% a day after it announced a secondary stock offering. The offering of 18 million Class A shares by selling shareholders will be held concurrently with the repurchase of 3.1 million Class A shares. Partnership interests in a company unit also will be bought back.

Arm Holdings — Shares slipped as much as 2% in midday trading during its second session as a public company, but were recently up nearly 1%. Investment banking firm Needham initiated coverage of the stock at hold without a price target following Arm’s debut that valued the company at about $60 billion. Needham analyst Charles Shi cautioned, however, that the stock’s value already “looks full.”

Insulet, Dexcom — Shares of the diabetes-focused health-care companies fell Friday after Bloomberg News reported Thursday afternoon that Apple has selected a new leader for its team working to develop a noninvasive blood sugar monitoring device. Shares of Insulet shed 3%, while Dexcom sank 3.8%.

Chipmakers — Chip equipment stocks ASML Holding, KLA, Lam Research and Applied Materials dropped nearly 4% each following a report that Taiwan Semiconductor is telling vendors to delay deliveries due to demand concerns. U.S.-listed shares of Taiwan Semiconductor lost 2%.

Adobe — Shares of the Photoshop maker dropped 4% following Adobe’s fiscal third-quarter earnings Thursday. The company reported an earnings and revenue beat and forward guidance that matched Street projections. While Goldman Sachs and Bank of America reiterated buy ratings, JPMorgan remained neutral, citing macroeconomic headwinds and a high premium for Adobe’s pending acquisition of Figma for $20 billion.

Apellis Pharmaceuticals — The biopharmaceutical company advanced 7.5% following a Wells Fargo upgrade to overweight from equal weight. The bank said Apellis has a favorable risk/reward ahead of third-quarter earnings.

DoorDash — Shares of the food delivery company fell 3% after MoffettNathanson downgraded the stock to market perform from outperform. The Wall Street firm said the resumption of loan repayments introduce bookings risk to food delivery. The stock is still up more than 60% this year.

Axis Capital — The insurance stock rose 2.7% following an upgrade to buy from underperform by Bank of America. The Wall Street firm said its pessimistic outlook was changing despite recent underperformance in the reinsurance space.

Estée Lauder — The cosmetics stock advanced nearly 2% after Redburn Atlantic Equities turned less bearish. The firm upgrades shares to neutral from sell, saying the company was feeling technical benefits as customer ordering patterns normalize.

Casella Waste Systems — The waste stock traded about 1.6% higher after getting initiated by Goldman Sachs at buy. Goldman called the company a “compounder with pricing.”

— CNBC’s Yun Li, Jesse Pound, Samantha Subin, Pia Singh, Brian Evans and Lisa Kailai Han contributed reporting.

Safety Shot’s stock reverses sharply lower, as hangover remedy company’s name and ticker change take effect

Shares of Safety Shot Inc.

SHOT,

tumbled 13.8% in premarket trading Friday, reversing an earlier rocket ride, as the name and ticker change of the hangover remedy and wellness company takes effect. The stock had been up as much as 136.8% early in premarket trading, before turning lower. The company’s stock ticker will change to “SHOT” from “JUPW” at the opening bell. The company formerly known as Jupiter Wellness Inc., which developed cannabidiol (CBD)-based medical therapeutics, acquired the operating assets of GBB Drink Lab Inc. in August, including the blood alcohol detox drink Safety Shot. When the deal closed on Aug. 11, Jupiter Wellness had said it expects most of its revenue in the coming quarters and years to be driven by Safety Shot, which the company said can lower blood alcohol content by up to 50% in 30 minutes. On Friday, the company said Safety Shot is currently going into production across the U.S. as it prepares for the product launch in the fourth quarter. The stock has run up 74.7% since Aug. 11 through Thursday, and has skyrocketed 461.2% over the past three months.

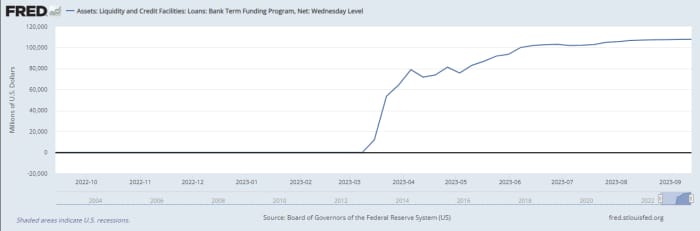

Fed’s lending to financial institutions sees pickup in demand

Financial institutions are increasingly taking advantage of an emergency program created by the Federal Reserve in March after the collapse of California’s Silicon Valley Bank.

As of Wednesday, they borrowed almost $108 billion from the Fed’s Bank Term Funding Program, which was designed to provide an additional source of liquidity at times of stress, according to data from the central bank. That’s up by $138 million from the prior week. The increased borrowing occurred during a one-week period in which Treasury yields were not far from some of their highest levels of this year, a sign of diminished demand for underlying government debt.

Source: Federal Reserve Board of Governors

The Fed’s BTFP was created in March as a way to ensure institutions would be able to meet the needs of their depositors, and offers loans of up to one year in exchange for collateral such as Treasurys, plus agency and mortgage-backed securities. The program is intended to eliminate a financial institution’s need to rapidly sell securities, and is open to federally insured banks, savings associations, and credit unions, as well as the U.S. branches of foreign banks.

The Fed announced its Bank Term Funding Program on March 12, a Sunday, the same day that New York’s Signature Bank was closed by regulators. Two days earlier, Silicon Valley Bank had collapsed after a run on its deposits and a crisis of confidence triggered by the bank’s forced sale of a portfolio at a roughly $1.8 billion loss.

Now, banks’ use of the emergency BTFP facility “has been creeping up over time” because it offers relatively attractive financing when compared with the Fed’s discount window, said Thomas Simons, a U.S. economist at Jefferies

JEF,

“To the extent that usage continues to climb, it offers proof that banks need that much more liquidity,” Simons said via phone on Friday. “But the increase so far is not enough to signal new problems in the banking system. It’s more indicative of the current state in which deposits are getting more expensive to retain, and banks are trying to manage that.”

As of Friday, investors and traders were looking ahead to next Wednesday’s policy announcement by the Federal Reserve. Three- to 30-year Treasury yields all inched higher in afternoon trading. Meanwhile, all three major U.S. stock indexes

DJIA

COMP

were down.

The 3 Most Undervalued Materials Stocks to Buy in September 2023

My mission, should I choose to accept it, is to find the three most undervalued materials stocks to buy in September.

Dr. Ed Yardeni and his capable crew at Yardeni Research produce interesting charts weekly about the S&P 500. I’m always looking at sector performance, both monthly and year-to-date (YTD).

In the latest edition, materials stocks from the index were up 5.9% YTD through Sept. 14. That puts it well below the 17.8% return for the entire index.

Surprisingly, despite delivering one-third of the index’s performance in 2023, materials stocks are doing better than five of the 10 other sectors. If not for the 30+% return of three sectors: communication services, consumer discretionary, and technology, materials stocks would be near the top. In August, materials had the third-worst showing, down 3.5%. Only utilities (-6.7%) and consumer staples (-3.8%) were worse.

Yardeni breaks down the materials sector performance YTD into eight different sub-sectors. The three worst performers from this cohort were gold (-16.3%), fertilizers & agricultural chemicals (-14%), and diversified chemicals (-5.3%).

Therefore, it makes sense to select my undervalued materials stocks from each of these sub-sectors. Here’s hoping they can rebound before the end of the year.

Newmont (NEM)

Newmont (NYSE:NEM) is the world’s leading gold producer.

In May, the company announced it would acquire Australian gold producer Newcrest Mining (OTCMKTS:NCMGY) for 28.8 billion Australian dollars. Upon the transaction closing, the combined entity will produce 8 million ounces of gold annually.

Newmont and Newcrest are working their way through all the countries that have to give a regulatory thumbs up to the merger. Australia’s Competition & Consumer Commission is the most recent regulatory body to approve the deal. It did so on Aug. 21.

In the meantime, Newmont shareholders will vote on Oct. 11, followed two days later by Newcrest shareholders. If both groups approve and there are no regulatory snafus, the all-stock deal will see Newmont shareholders own 69% of the combined entity, with Newcrest’s shareholders owning 31%.

From Newmont’s April 2022 high of $86.37, the company’s shares are down 54%. It currently trades at 2.8x sales, its lowest multiple since 2018.

In the company’s Q2 2023 press release, Chief Executive Officer (CEO) Tom Palmer called Newmont’s balance sheet “the industry’s strongest.” As of June 30, its net debt was $2.91 billion, or just 9% of its market cap. Considering how much these mines cost to open and operate, it’s reasonable.

Doing an all-stock deal could turn out to be Newmont’s wisest decision, even if it does cost its shareholders massive dilution.

Newcrest’s 2022 revenue was $4.21 billion, down 8% from 2021. Newmont’s were $11.92 billion. The company’s pro forma revenue for 2022 would have been $16.13 billion. Its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) would have been $6.6 billion for a 40.9% margin.

NEM isn’t too far off its 52-week low of $37.45. Buying below $40 makes a ton of sense, given the combined entity’s financial strength.

FMC (FMC)

FMC (NYSE:FMC) is a Philadelphia-based provider of crop protection solutions such as insecticides, herbicides and fungicides. These three product lines account for 58%, 28%, and 7%, respectively. Other products account for the remaining 7%. Farmers depend on it.

The biggest problem with the company’s business model is its reliance on its customers (farmers, etc.) and local weather. In the second quarter, for example, revenue was down 30% (28% excluding currency) over last year, partly because of a drought in Brazil and Argentina. The results could have been much worse if not for its product innovation.

“Demand for the company’s innovative products remained resilient as sales from new products launched in the last five years were essentially flat to the prior-year period despite the overall sales drop,” FMC’s Q2 2023 press release stated.

The good news is that its revenue in the second half is only expected to fall by 2% year-over-year. As a result, its full-year outlook calls for a 9% decline YoY. Its adjusted EBITDA in 2023 is projected to be $1.35 billion at the midpoint of its guidance, down 4% from 2022. However, it expects adjusted EBITDA to grow by 16% in the second half.

Unfortunately, there is a worldwide move to reduce inventories. FMC must wait it out.

Down nearly 40% YTD, FMC stock is trading at its lowest point since the March 2020 correction. The last significant drop before that was in 2014 and 2015.

If held for 3 to 5 years, the mid to low-$70s is a good entry point for FMC stock. The demand for FMC’s products isn’t going away anytime soon.

Celanese (CE)

Unlike the other two stocks in this article, Celanese (NYSE:CE) is having an excellent year, up more than 25% YTD. Yet, I still believe it’s undervalued, despite reporting earnings in early August that missed on the top and bottom lines.

In Q2 2023, its revenue was $2.80 billion, 12.4% higher than Q2 2022, but over $40 million shy of the Zacks Consensus Estimate. On the bottom line, Celanese earned $2.17 a share, 57% lower than a year ago and 29 cents lower than analyst expectations. Its shares dropped by several percentage points on the miss. However, it has since regained all August losses.

Celanese has two reportable segments: Engineered Materials (56% of sales) and Acetyl Chain (44%). The former segment’s products include nylon compounds, Polyethylene terephthalate (PET), and thermoplastics. The latter business is best known for producing acetic acid used to make vinegar. Industrially, it’s essential for producing plastics, photographic film and paint.

The company’s revenue has started to slow — it was down 2% from Q1 2023 — forcing it to initiate cost cuts across its entire operation, including a reduction in inventory and production levels.

In June, the company formed a joint venture with Mitsui & Co. (OTCMKTS:MITSF) to operate a food ingredients business named Nutrinova. Celanese is contributing its food ingredients assets, technology and employees to the joint venture.

Mitsui is paying $473 million for 70% of the business. Celanese retains 30%. Most importantly, Celanese will use the proceeds to pay down debt.

Why buy CE stock? Its free cash flow was $611 million in the second quarter, 18% higher than any quarter in the company’s history. You usually can’t go wrong with healthy free cash flow.

On the date of publication, Will Ashworth did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Goldman Sachs names exec to new unit within Wealth Management business

Goldman Sachs Group Inc.

GS,

on Friday named executive Monali Vora as head of the bank’s new Wealth Investment Solutions unit within its Asset Management division. Wealth Investment Solutions is aimed to “serve the evolving needs of our ultra-high net worth, high net worth and mass affluent client base and their desire for bespoke, personalized portfolios,” according to an internal memo seen by MarketWatch. Monali previously worked as head of Quantitative Equity Solutions, which is being renamed Equity Solutions. Goldman Sachs stock was up fractionally on Friday. So far in 2023, the stock is up 0.4%, compared to a 4.7% rise by the Dow Jones Industrial Average

DJIA,

Drive Far Away From Lucid Stock and Never Look Back

Sometimes, I’ll root for an underdog. However, I just can’t get behind electric vehicle (EV) manufacturer Lucid Group (NASDAQ:LCID) in 2023. LCID stock has been a poor performer and could easily continue to lose value this year.

I’m not the only commentator who’s concerned about Lucid Group’s future prospects. As we’ll see, at least one expert on Wall Street is unafraid to point out Lucid Group’s major problems.

In addition, Lucid might soon expand its operations into a highly populated region of car buyers. At first blush, this may seem bullish. However, be sure to consider the implications as Lucid Group potentially endeavors to step outside of its comfort zone.

An Analyst’s Warning for LCID Stock Traders

If you’re ultra-optimistic about LCID stock, I encourage you to tap the brakes and heed the warning of Baird analyst Ben Kallo. He published a lukewarm “hold” rating on the stock, along with some cautionary comments about Lucid Group.

To be fair, Kallo actually praised Lucid’s automotive technology. He stated that Lucid Group’s software and drivetrain are “both developed in house to enable industry-leading performance in range, efficiency, charging, and more.”

That’s high praise, but the Baird analyst also noted some red flags. First, Kallo Group asserted that Lucid Group faces a “challenging near-term setup” due to “high starting prices and a niche-market segment.” I tend to agree with this assessment, as many customers simply can’t afford Lucid’s high-end EVs during these challenging economic times.

Furthermore, Kallo observed that “[p]rofitably ramping EV production has proven to be a difficult task” that “has already challenged [Lucid] in its short operating history.” On top of that, Kallo expressed concerns that “[c]omponent shortages and supply-chain tensions have led to [Lucid] reducing its vehicle production guidance multiple times and could adversely impact results yet again.”

Could Lucid Group end up having to borrow money or issue shares? It’s entirely possible, as Kallo suggested that Lucid “will need to raise more capital to execute on its strategic growth plan, which may more more challenging in a high cost-of-capital environment.”

Lucid Group’s Potential Foray Into China Would Be Risky

With Kallo’s assistance, I’ve already conveyed multiple issues that Lucid Group will need to overcome. Yet, if the company follows through with a potential expansion plan, Lucid might only end up compounding its problems.

Recently, CNBC broke the story that Lucid Group is “exploring selling its cars in China.” However, the company apparently has “no timeline” for this.

Actually, there’s more to this story. Eric Bach, chief engineer at Lucid Group, reportedly announced that selling vehicles in China is “something we are exploring, we are investing in.” To me, “investing in” China EV sales sounds more serious and definite than just “exploring” it.

Bach practically admitted that a venture into China would be risky for Lucid Group. “If you enter China on the wrong terms, you can make a lot of mistakes,” he acknowledged. Plus, Bach seemed to offer more questions than answers: “[H]ow are we going to enter? What’s the pricing strategy? What’s going to be our manufacturing strategy?”

Until these questions are answered specifically and decisively, I’m skeptical about Lucid Group’s ability to succeed in China’s ultra-competitive EV market. Bear in mind, Lucid hasn’t been extremely successful in the U.S.

As I’ve pointed out before, Lucid Group has literally halved its 2023 EV production forecast from 20,000 to 10,000 units. Moreover, Lucid Group missed Wall Street’s call for second-quarter sales of $182 million and an earnings loss of 34 cents per share. The actual results, unfortunately, were roughly $151 million in sales and an earnings loss of 40 cents per share.

LCID Stock Has ‘Trouble’ Written All Over It

By now, Kallo’s cautionary notes should have made you think twice about investing in Lucid Group. Also, consider whether it might be a costly mistake for Lucid to venture into China’s competitive EV market.

Lucid Group’s loyal shareholders haven’t been long-term winners, and I’m not optimistic about the coming quarters. Hence, at the end of the day, the best policy is to avoid LCID stock altogether.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

TSMC reportedly delays Arizona equipment deliveries, shares of suppliers drop

American depositary receipts of third-party chip fab Taiwan Semiconductor Manufacturing Co.

TSM,

fell Friday and weighed upon the chip sector following a report it was reaching out to chip-equipment vendors to delay deliveries. Early Friday, Reuters reported that TSMC was delaying deliveries of equipment to the facility it is building in Arizona, cautious of the demand outlook, citing two sources close to the matter. U.S. shares of TSMC fell 2% in Friday trading with the PHLX Semiconductor Index

SOX,

down 2.4%, as shares of chip-equipment makers Applied Materials Inc.

AMAT,

and KLA Corp.

KLAC,

both fell 4%, and both Lam Research Corp.

LRCX,

and ASML NV

ASML,

declined 3.5%. Meanwhile the S&P 500 index

SPX,

was down 1%.

RayzeBio stock opens with a big gain, to push valuation up to $1.4 billion

Investors cheered RayBio Inc. as it debuted on Wall Street, as the California-based radiopharmaceutical company’s stock

RYZB,

opened 38.9% above the initial public offering price. The company had raised $311 million as it sold 17.3 million shares in the IPO, up from an expected 14.4 million shares, with the IPO pricing at $18 a share, at the top of the expected range. The stock’s first trade on the Nasdaq was at $25.00 at 11:38 a.m. Eastern for 629,709 shares. At that price, the company market capitalization was $1.38 billion. RayzeBio’s upbeat debut comes a day after high-profile semiconductor-design company Arm Holdings PLC

ARM,

was also cheered in its debut, with Arm’s stock closing Thursday 24.7% above its IPO price. RayzeBio’s stock has gained ground since it opened, as it was last up 39.6%. The back-to-back upbeat debuts comes as the Renaissance IPO ETF

IPO,

has edged up 0.1% over the past three months while the S&P 500

SPX,

has gained 0.9%.