Instacart

CART,

plans to raise the target price for its initial public offering after the successful debut of Arm Holdings

ARM,

on Thursday, the Wall Street Journal reported, citing people familiar with the matter. The report said the grocery delivery service will now seek a range between $28 and $30 per share, up from its previous range of $26 to $28. ARM shares jumped 25% to $63.59, after pricing its IPO at $51.

Nio’s stock rises again, in wake of rate cut in China and UAW strike against U.S. automakers

Shares of Nio Inc.

NIO,

climbed 2.7% in premarket trading Friday, adding the 3.1% bounce in the previous sessions, as a strike impacting some U.S. autoworkers and some and a interest rate cut in China let support for the China-based electric vehicle maker. The stock’s rally comes after it slumped 4.7% on Wednesday, after the European Union launched an investigation into China’s subsidies to its EV makers. China hit back at the EU’s move, calling it “naked protectionism” and saying it could hurt trade relations between the EU and China. Meanwhile, China’s central bank cut a short-term policy rate on Friday, in an effort to boost economic growth. What may also be helping Nio’s stock, the labor strike impacting General Motors Co.

GM,

Ford Motor Co.

F,

and Chrysler parent Stellantis N.V.

STLA,

is seen as benefiting competitors with non-union labor forces, such as fellow EV maker Tesla Inc.

TSLA,

Tesla’s stock rose 0.5% ahead of the open. Elsewhere, shares of fellow China-based EV makers also advanced, with XPeng Inc.’s stock

XPEV,

up 1.5% and Li Auto Inc. shares

LI,

up 0.3%.

Activist Elliott makes inroads at Catalent to build value. Here’s what could happen next

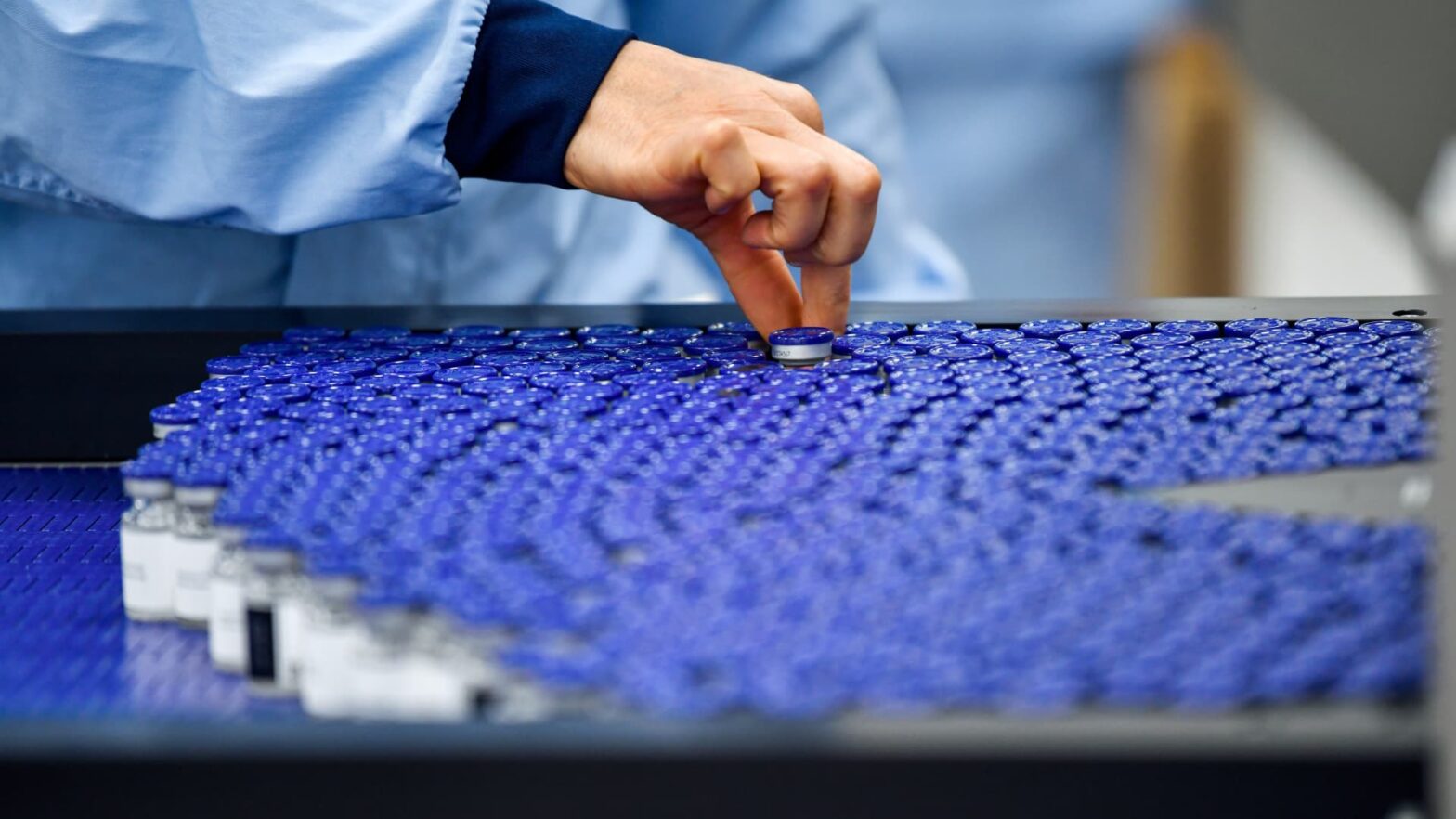

Rows of glass vials in a biologics laboratory in Sweden. Photographer: Mikael Sjoberg/Bloomberg

Bloomberg Creative | Bloomberg Creative Photos | Getty Images

Company: Catalent (CTLT)

Business: Catalent develops and manufactures solutions for drugs, protein-based biologics, cell and gene therapies, and consumer health products worldwide. The company operates through four segments. First, there’s Softgel and Oral Technologies, which provides formulation, development, and manufacturing services for soft capsules for use in a range of customer products. Biologics provides biologic cell-line, and it develops and manufactures cell therapy and viral-based gene therapy. This segment also handles the formulation, development and manufacturing for parenteral dose forms, including vials and prefilled syringes. The Oral and Specialty Delivery segment offers formulation, development and manufacturing across a range of technologies, along with integrated downstream clinical development and commercial supply solutions. Finally, the Clinical Supply Services segment offers manufacturing, packaging, storage, distribution and inventory management for drugs and biologics, as well as cell and gene therapies in clinical trials.

Stock Market Value: $8.86B ($49.16 per share)

Activist: Elliott Investment Management

Percentage Ownership: n/a

Average Cost: n/a

Activist Commentary: Elliott is a very successful and astute activist investor, particularly in the technology sector. Its team includes analysts from leading tech private equity firms, engineers, operating partners – former technology CEOs and COOs. When evaluating an investment, the firm also hires specialty and general management consultants, expert cost analysts and industry specialists. The firm often watches companies for many years before investing and have an extensive stable of impressive board candidates. Elliott has not disclosed its stake in this investment, but based on the firm’s history, we would expect it to be approximately $1 billion.

What’s happening?

On Aug. 29, Elliott and the company entered into a cooperation agreement pursuant to which Catalent agreed to temporarily increase the size of the board from 12 to 16 directors and appoint Steven Barg (global head of engagement at Elliott), Frank D’Amelio (former CFO and EVP, global supply, of Pfizer), Stephanie Okey (former SVP, head of North America, rare diseases, and U.S. general manager, rare diseases at Genzyme) and Michelle Ryan (former treasurer of Johnson & Johnson). The company will reduce the size of the board at the 2023 annual meeting; it agreed to nominate a slate of 12 candidates, including the four new directors. Catalent also agreed to establish a strategic and operational review committee, charged with conducting a review of the company’s business, strategy and operations, as well as its capital allocation priorities. This committee will include new directors Barg and Ryan. Further, John Greisch (former president and CEO of Hill-Rom Holdings) has been appointed executive chair of the board and will also chair the newly formed committee. Elliott agreed to abide by certain customary voting and standstill provisions.

Behind the scenes

Catalent is an outsourced manufacturer in the pharmaceuticals industry. This is a stable business in a growing industry operating in an oligopoly. It’s one of the three largest global contract development and manufacturing organizations, next to Lonza and a division of Thermo Fisher. The company was always seen as a market leader, but in the middle of 2022 the tides began to turn, largely due to two main factors. First, Catalent was negatively affected by a Covid cliff: During the pandemic, the government mandated that the company shut down much of its manufacturing and start producing Covid vaccines. This production led to $1.5 billion in revenue that recently went to zero. Second, Catalent had several self-inflicted wounds, including an acquisition that did not pan out like they expected and operational and regulatory issues. These are fixable issues that have sunk the stock from $142.35 in September 2021 to $48.82 this month, but they do not necessarily adversely affect the long-term intrinsic value of the company. That makes this situation an excellent opportunity for an activist.

In its most simplistic form, there are two basic elements to an activist campaign: success in the activism (for instance, getting the company to adopt your agenda) and execution of the activist agenda. Elliott has already accomplished the former, having entered into the cooperation agreement for four board seats. There’s also the establishment of a strategic and operational review committee and appointment of Greisch as executive chair of the board and as chair of the newly formed committee. While this committee’s purview is business, strategy and operations, we expect it will put an emphasis on strategy.

This is a very strategic asset, and there are likely to be several interested acquirers. In fact, on Feb. 4, Bloomberg reported that fellow life sciences conglomerate Danaher had expressed interest in purchasing Catalent at a “significant premium.” Catalent ended Feb. 3 at $56.05 per share, and the stock popped nearly 20% the following trading session. Ultimately, a deal with Danaher never materialized. Additionally, companies like Merck could be interested in buying the company or parts of it. Another possibility is an acquisition by private equity, of which Elliott’s PE arm could be an interested party. While as an activist Elliott will do whatever it feels is necessary to enhance shareholder value, in the past the firm has made significant use of the strategy of offering to acquire its portfolio companies as the best catalyst to enhance shareholder value. We would not be surprised to see that happen here. Catalent is the right size for Elliott, which recently partnered on buyout deals for Citrix Systems and Nielsen Holdings, each for roughly $16 billion. Elliott has also recently shown interest in this industry, partnering with Patient Square Capital and Veritas Capital to acquire Syneos Health (SYNH) for $7.1 billion. That acquisition is expected to close in the second half of 2023. Like Catalent, Syneos is an outsourced pharma solutions company: It outsources R&D for pharmaceutical companies, whereas Catalent outsources manufacturing.

Elliott quickly got Catalent to pursue a strategic exploration agenda, which indicates to us that there was not a lot of pushback by management. We expect that this review will conclude with a sale of the company. However, it is worth noting that Catalent has a relatively new CEO at the helm, Alessandro Maselli, who was promoted from president and COO in July 2022. A lot of the operational issues happened during his watch. If this does turn from a strategic review to an operational review, there is no guarantee that he keeps his job.

Ken Squire is the founder and president of 13D Monitor, an institutional research service on shareholder activism, and the founder and portfolio manager of the 13D Activist Fund, a mutual fund that invests in a portfolio of activist 13D investments.

Instacart raises IPO price range to $28 to $30 a share from $26 to $28 previously

Grocery-delivery app Instacart

CART,

raised the proposed price range for its planned initial public offering on Friday to $28 to $30 from $26 to $28 previously. The move was expected after the Wall Street Journal reported it would do so in the wake of Arm Holdings’

ARM,

successful IPO on Thursday , citing people familiar with the matter. Instacart is planning to offer 22 million shares to raise $660 million at the top of that range at a valuation of $8.3 billion. As part of the deal, PepsiCo

PEP,

has agreed to purchase $175 million of Instacart’s Series A redeemable convertible preferred stock.

RayzeBio valued at nearly $1 billion as upsized IPO prices at top of expected range

RayzeBio Inc.

RYZB,

has secured a near-$1 billion market valuation, as the California-based radiopharmaceutical company’s upsized initial public offering priced at the top end of the expected range. The company said it offered 17.28 million shares in the IPO, up from previous expectations of 14.4 million shares, to raise $311.0 million. The IPO priced late Thursday at $18, compared with previous expectations of a pricing between $16 and $18 a share. With 55.36 million shares outstanding expected after the IPO, the pricing values RayzeBio at $995.7 million. The stock is expected to begin trading on the Nasdaq after Friday’s open under the ticker symbol “RYZB.” The company is going public at a time of growing investor interest in IPOs, as semiconductor-design company Arm Holdings PLC’s stock

ARM,

soared on its debut and as grocery-delivery app Instacart

CART,

raised the expected pricing range of its IPO. The Renaissance IPO ETF

IPO,

has run up 34.6% year to date while the S&P 500

SPX,

has gained 17.3%.

Cannabis banking measure may win approval in Senate, report says

The Secure and Fair Enforcement (SAFE) Act, also known as the SAFE Banking Act, will be voted on in committee by the end of the month and should have enough votes to pass the U.S. Senate, according to a report by NBC-TV. Three sources familiar with the talks told NBC-TV the Senate Banking, Housing, and Urban Affairs Committee plans to hold a markup meeting for SAFE Banking during the week of Sept. 25. It could then go before the full Senate for the first time since the measure was introduced 10 years ago. SAFE Banking has passed the U.S. House of Representatives in the past but it’s fate is less certain now because of GOP control of the chamber. The AdvisorShares Pure US Cannabis ETF

MSOS,

was up 2.7% in premarket trading on Friday, on top of a 6% rise in regular trading in the previous session. The SAFE Banking Act is intended to make it easier for cannabis companies to transact business without the federal impediments that come with the plant’s current classification as a Schedule I drug with no medical uses under U.S. law.

The 3 Most Undervalued Manufacturing Stocks to Buy in September 2023

Source: Gorodenkoff via Shutterstock

After years of factory closures and offshoring, manufacturing is returning to America. A 2022 report by the consulting firm McKinsey & Co. said that manufacturing in the U.S. is experiencing a “renaissance”. It noted that the sector today accounts for $2.3 trillion in annual gross domestic product (GDP), employs 12 million people, and directly supports hundreds of communities across the country.

New York Times (NYSE:NYT) columnist David Brooks recently wrote an article entitled “The American Renaissance Is Already at Hand“. He discusses the growth in U.S. manufacturing of everything from electric vehicles and microchips to renewable energy infrastructure. Brooks also highlights that the U.S. has added 530,000 net new manufacturing jobs since 2017.

Increasingly, the U.S. is gaining a competitive edge in manufacturing on long-time rivals that offer cheaper labor such as Mexico and China. While all of this is encouraging, the boom hasn’t yet been reflected in the stocks of manufacturing companies. Many manufacturing stocks are stagnant or trailing the broader market as gains remain concentrated in a few technology names.

Let’s examine the three most undervalued manufacturing stocks to buy this month.

General Electric (GE)

Industrial powerhouse General Electric’s (NYSE:GE) stock has had a big run this year but still looks undervalued by historic standards. The manufacturer of products ranging from wind turbines to aircraft engines has seen its share price rise 74% this year.

However, GE stock is currently trading 70% below the price it was at back in 2000. Furthermore, the stock went through a 1-for-8 reverse stock split in 2021 that was used to artificially inflate the share price. This happened as the company struggled with declining sales and a massive reorganization.

This year’s run in GE stock came after the company spun off its healthcare unit in January. This move will enable the company to focus more on its core businesses of aerospace and renewable energy. General Electric’s shares are now trading at 13 times forward earnings, which is low for a company of its size. And despite this year’s big move in the stock, analysts expect further gains. The median price target on GE stock is 14% higher than where the shares currently trade.

Illinois Tool Works (ITW)

Founded in 1912, Illinois Tool Works (NYSE:ITW) produces fasteners, components, and equipment that are needed in manufacturing and construction. ITW stock has only risen 8% this year, trailing the broader market. The shares are currently trading at 23 times forward earnings, which is in line with the average price-earnings (P/E) ratio among stocks in the S&P 500 index.

Also, ITW stock pays a strong quarterly dividend of $1.40 a share, which gives it a yield of 2.34%. In early August, the company’s board of directors approved a 7% increase to the dividend, marking the 52nd of raising its dividend. The board also approved a new $5 billion stock buyback program, which further benefits stockholders. ITW stock has been a long-term winner, having gained 65% over five years and increased 220% over the past decade.

Hewlett-Packard (HPQ)

Hewlett-Packard, commonly known as HP (NYSE:HPQ) is a major manufacturer of personal computers as well as traditional and 3D printers. The company is the second largest computer manufacturer in the world after Lenovo.

While many technology companies have seen their share prices take off this year, HPQ stock has been a laggard. Over the last 12 months, HP’s share price has increased a slight 2%. Over five years, the stock is up only 10%.

However, HPQ stock looks affordable right now, trading at just 12 times future earnings estimates. This is considered cheap for a tech company with a market cap of nearly $30 billion. HP also offers a high yield dividend to its shareholders. The company currently pays 26 cents a share per quarter for a yield of 3.78%. HPQ stock took a hit recently when it was revealed that famed investor Warren Buffett reduced his holding in the company, selling 5.5 million shares. However, Buffett still owns more than 10% of HP.

On the date of publication, Joel Baglole did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

New game-engine fees ‘unlocking engine for growth’ at Unity, as analyst upgrades stock to a buy

Unity Software Inc. gained an analyst upgrade on Friday on the belief the company’s new game-developer fees will turn its game engine into a growth engine.

On Friday, B. of A. analyst Michael Funk upgraded Unity

U,

to a buy from neutral, and hiked his price target to $56 from $46, because his analysis of the company’s new fee structure “implies improved monetization of the company’s industry leading mobile game creation engine,” which in turn, unlocks Unity’s “engine for growth.”

Unity shares closed up 1.7% at $36.32, for a 3.6% decline on the week, while the broader market sold off with the S&P 500 index

SPX

falling 1.2% Friday, for a weekly loss of 0.2%.

Of the 28 analysts who cover Unity, 19 have buy-grade ratings, seven have hold ratings, and two have sell ratings, along with an average price target of $47.15, according to FactSet data.

On Wednesday, Unity met with blowback after it announced in a Tuesday blog post it would charge more established game developers every time their game was downloaded.

One analyst considered it a “PR disaster,” but saw the upside in the new fees, while shares fell 5.5% Wednesday, and another 3% on Thursday.

Funk said he believes mobile ad spending has stabilized and that “known risks and execution issues are more than priced into the stock.”

Why QuantumScape Stock Is a Lose-Lose for Investors

QuantumScape (NYSE:QS) is a speculative growth stock, but this categorization isn’t what makes QS stock a questionable investment opportunity.

You know the saying: nothing ventured, nothing gained. If the odds are in your favor, taking calculated risks in early-stage stocks with a high degree of uncertainty can be a profitable strategy.

The issue with this electric vehicle battery technology play isn’t that the odds are long. Rather, the issue is that, at today’s prices, the odds aren’t in your favor.

QuantumScape may on the surface seem like a binary bet. Either the company brings a solid state battery (or SSB) for EVs to market, or it doesn’t.

But while shares would likely rally if the company were to hit the commercialization stage, there are additional factors that could make this stock a losing bet for those buying in at present price levels, as I’ll explain below.

QS Stock: ‘High Risk, High Reward?’

SSBs are a potential game-changer for the EV battery space. They offer range and safety advantages over the lithium ion batteries predominantly in use today.

If it becomes possible to build SSBs for EVs on a mass scale, chances are they will supplant usage of lithium ion batteries in a brief span of time.

This argument is why investors were willing to bid up QS stock to prices topping $100 per share during the height of “EV mania,” and it’s why many continue to dabble in shares. Even as they languish in the stock market graveyard.

Keep in mind that, while QuantumScape may finally have a breakthrough down the road, that doesn’t mean prices substantially above what QS trades for today (around $7 per share).

There are factors that could continue to weigh on the stock prior to a possible breakthrough. Plus, the market could react less favorably to a breakthrough than you would think.

Moderate Downside, Underwhelming Upside

QS stock investors may have realistic expectations when a possible “payoff moment” will arrive for shares.

These investors aren’t thinking that the stock could rally in a big way within the next few months or quarter. They know that it’s going to take years for the QuantumScape “story” to take shape.

Unfortunately, while “years” to some may suggest things begin to payoff within two to five years, that may not be the case. Many believe QuantumScape’s entry to the commercialization stage will arrive by the mid-to-late 2020s.

However, as one EV metals analyst (Rory McNulty) has argued, mass production of SSBs for EV may be around a decade away from happening.

With such a long timeline, impatience will undoubtedly weigh on QS shares. If that’s not bad enough, as I’ve pointed out previously in past QS articles, there’s a high chance of continued shareholder dilution with this stock.

The need to raise more funds in order to finance further development/commercialization of SSB technology is something else that will likely weigh on shares.

Yet even if McNulty’s forecast is too conservative, and that future dilution is moderate at worst, something else may limit QuantumScape’s ultimate upside potential: competition.

The Bottom Line

As I pointed out back in August, QuantumScape is far from being the only SSB contender out there.

Myriad companies, ranging from large, global powerhouses like Samsung SDI and Toyota Motor (NYSE:TM), to other SSB startups like Solid Power (NASDAQ:SLDP), are aiming to grab a piece of this potential market.

Some of these contenders could beat QuantumScape to the punch, gaining first-mover advantage, and limiting QS’s potential to capitalize on this technology.

Even if QS keeps pace, and rolls out its EV SSB at the same time, the high competition could hurt margins. Also, QuantumScape may have difficulty securing big-ticket end-users beyond its current strategic partner Volkswagen (OTCMKTS:VWAGY).

Taking all of this account, it’s easy to see why an investment in QS stock today could prove unprofitable, irrespective of the company’s success in the SSB space.

On the date of publication, Thomas Niel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Stocks finish lower; S&P 500 gives up weekly gain as investors await Fed

Stocks ended lower Friday as investors assessed the start of a United Auto Workers strike against Ford

F,

General Motors

GM,

and Stellantis

STLA,

and awaited next week’s Fed decision. The Dow Jones Industrial Average

DJIA,

declined nearly 290 points, or 0.8%, to close near 34,619, according to preliminary data. The S&P 500

SPX,

shed 0.8% and the Nasdaq Composite

COMP,

slid 1.6%. The declines left the Dow with a weekly gain of 0.1%, while dragging the S&P 500 to a 0.2% drop and leaving the Nasdaq down 0.4%.