Shares of Nikola Corp.

NKLA,

gained 0.8% in premarket trading Monday, adding to the recent sharp gains, after the electric vehicle maker said it named Mary Chan as its chief operating officer, effective Oct. 9. Chan was a managing partner at VectoIQ, which was the special purpose acquisition company (SPAC) that took Nikola merged with to go public. “Mary brings a solid understanding of business, combined with extensive experience in technology and transportation, spanning both engineering and management,” said Nikola Chief Executive Steve Girsky. “Her expertise will be a tremendous asset to the Nikola team.” The stock has soared 36.8% over the past two sessions, fueled by the company saying it expects the first hydrogen fuel cell trucks to be delivered by the end of the month. The stock was little changed over the past three months through Friday but has tumbled 44.9% year to date, while the S&P 500

SPX,

has advanced 15.9% this year.

Tesla stock reverses lower again, in wake of WSJ report of talks to set up a manufacturing facility in Saudi Arabia

Shares of Tesla Inc.

TSLA,

reversed lower again, to trade down 1.0% in premarket trading Monday, in the wake of The Wall Street Journal report that the electric vehicle giant is in talks to set up a manufacturing facility in the Kingdom of Saudi Arabia. The stock had previously been up as much as 0.6% ahead earlier in the premarket. On Friday, the stock had gained as much as 1.1% intraday, as many see Tesla as a big beneficiary of the UAW strikes affecting the Big 3 automakers, but the stock reversed lower to close Friday down 0.6%. Citing people familiar with the discussions, Monday’s WSJ report said the talks are part of the Kingdom’s push to secure metals needed to make EV and to diversify its economy away from oil. The talks are at a very early stage and could still fall apart, the WSJ reported. The stock has gained 5.3% over the past three months through Friday, while the S&P 500

SPX,

has edged up 0.9%.

Stocks making the biggest moves premarket: DASH, ARM, PYPL

A DoorDash Inc. delivery bag sits on the floor at Chef Geoff’s restaurant in Washington, D.C.

Andrew Harrer | Bloomberg | Getty Images

Check out the companies making headlines in premarket trading.

PayPal – Shares of the payments giant fell more than 1% premarket after MoffettNathanson downgraded the stock to market perform from outperform and cut its price target 10 days before PayPal’s next CEO, Alex Chriss, is scheduled to take the helm. The firm said it’s excited about the new leadership, but that Chriss could have a challenging start after a difficult 18 to 24 months. MoffettNathanson sees the potential for further downside to its estimates.

DoorDash — Shares added nearly 2% after being upgraded by Mizuho Securities to buy from neutral on Sunday. The Wall Street firm said solid market share and strong consumer spending on food should help the delivery company surpass forecasts in the second half.

Micron Technology — The stock gained about 1.6% premarket after Deutsche Bank upgraded the memory and storage solutions company to buy from hold on Sunday, and also raised its target price. The firm said Micron’s pricing power with semiconductor direct random access memory is hitting an inflection point, and could push the company to beat first-quarter expectations.

Arm Holdings — Shares of the semiconductor company fell 3.7% in premarket trading as the newly public Arm tries to find its level in the market. Bernstein initiated coverage on Monday with an underperform rating, saying it was too early to say Arm will be an AI winner.

— CNBC’s Tanaya Macheel, Jesse Pound and Michelle Fox Theobald contributed reporting.

The 3 Best Machine Learning Stocks to Buy Now: September 2023

Machine learning has been the stuff of science fiction for longer than most of us have been alive. The 20th century was filled with stories of robots who could think and feel just like us. But computers in the 20th century lagged significantly behind what fiction had promised, and AI seemed like nothing more than a dream. But in the 21st century, the AI promise may be coming true. Machine learning stocks are bringing AI to every level of business and creativity. From art, to coding, to social media and beyond, AI is shaping the world around us and building our future. The machine learning stocks delivering those AIs to us will see the biggest returns for investors. And with the industry moving quicker every day, now is the best time to get in if you didn’t get in yesterday.

While many people still see AI as a passing fad, chatbots on the internet are not the AI revolution. The real revolution is happening in enterprise software and cloud services. There are machine learning tools available that significantly enhance worker productivity – and in many cases they’re being offered as an upsell on currently available cloud services. Thus many companies will have no choice but to buy if they don’t want their company to be left behind by their more productive competitors.

Not every company that uses the word “AI” will survive, of course. But the best bets are on some of the companies that already have a proven track record in the machine learning space. So for an investor who can’t wait for science fiction to become fact, here are three of the best machine learning stocks to buy today.

Adobe (ADBE)

Source: Tattoboo / Shutterstock

Adobe’s (NASDAQ:ADBE) synthesis of machine learning and art has transformed the creative industry for years. At the forefront of this innovation is Adobe’s flagship software, Photoshop, which now leverages generative AI to empower users to bring any imaginable image to life. With tools such as Firefly, users can turn text prompts into any image they wish. And with Photoshop’s other AI tools, it’s no wonder Adobe is used by art companies at every level.

What sets Adobe’s approach apart is its use of entirely Adobe-licensed art as the training data for these AI models. This addresses the ethical concerns some artists had for AI. Ethics often command a price premium where art is concerned, and Adobe’s commitment to assuaging artists’ desires puts them at the forefront of this new medium of art.

Furthermore, Adobe is actively embracing AI-generated art in other ways. They now offer AI-generated content in Adobe Stock, and will buy the rights to user-generated AI images as well. Adobe was already a leader in the technology of art, and their machine learning tools are only cementing that.

Adobe’s just-released earnings report also demonstrates their growth and dominance. In Q3 2023, revenue was $4.89 billion, growing 10% year on year. Dilute earnings per share were $3.05, up from $2.42 in Q3 2022. Adobe’s machine learning products are pushing both growth and earnings, and the best may yet be to come. And in proving that machine learning can be a creative tool as well, Adobe has proven to be one of the best machine learning stocks to buy.

Alphabet (GOOG, GOOGL)

Source: Koshiro K / Shutterstock.com

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL), the parent company of Google, stands at the forefront of the AI revolution with its array of enterprise-level technologies and services. Google has already indexed the web for search, now it can use that indexing for building machine learning applications and AI. The most visible AI from Alphabet is Google Bard. This ChatGPT-like AI can answer questions and assist users in web searches. But Bard’s influence is far overshadowed by Alphabet’s other offerings.

In the enterprise sector, Alphabet has integrated machine learning and AI tools into its cloud services, adding them as an upcharge. This includes tools such as Google Duet. Google Duet can help write emails, make presentations and find data in both Google Drive and Gmail. It can even help complete code. This automates the mundane tasks of the day and increases worker productivity. And while Google Bard was delayed in its entry to Europe Duet’s is already available in all markets where Google Workspace is sold.

Because the real strength of AI lies in augmenting human productivity, much like computers and the internet did in the past. By automating repetitive tasks, AI liberates workers to focus on more creative and intellectual pursuits. Many companies will race to buy these new AI tools or risk getting left behind by their competitors. Buying an AI cloud service in 2023 is like getting your workers computers in 1993, and most companies probably know it. So as the company at the forefront of enterprise cloud and AI, Alphabet is one of the best machine learning stocks to buy right now.

Meta (META)

Source: Ascannio / Shutterstock.com

In the realm of machine learning stocks, Meta (NASDAQ:META) has taken a unique tact: make the tools open source. Meta, the parent company of Facebook, is emerging as a trailblazer in the AI landscape with LLaMa, the Large Language Model Meta AI. This open-source system can generate language, generate code and explain code in simple language. This versatility not only benefits the developer community but also holds the key to Meta’s continued dominance in social media.

Meta has long relied on AI and machine learning to identify and remove unwanted content across its many platforms. With over 3 billion monthly users on Facebook alone, manual content curation is impractical, if not impossible. To ensure a positive user experience and comply with global regulations, AI tools like LLaMa will be paramount. Meta has a long history of removing unwanted content with machine learning, LLaMa is just an evolution of that approach.

Crucially, Meta’s decision to open-source LLaMa allows the global community of developers to contribute to its enhancement. This collaborative approach harnesses the wisdom of the crowds and gives LLaMa far more developers than Meta could ever hire.

Machine learning is already indispensable for social media’s present and AI will be key to social media’s future. The ability to curate content, serve content tailored to users’ interests and target ads, are all powerful ways that Meta still stands above many of its social media peers. Add powerful AI tools to the mix and Meta is one of today’s hottest machine learning stocks to buy.

On the date of publication, John Blankenhorn held long positions in ADBE, GOOGL and META. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

U.S. stocks open little changed as Treasury yields edge up

U.S. stocks opened little changed on Monday, as Treasury yields edged higher and investors awaited housing-market data. The Dow Jones Industrial Average

DJIA,

was trading up 0.1% soon after the opening bell, while the S&P 500

SPX,

was down 0.1% and the Nasdaq Composite

COMP,

slipped 0.3%, according to FactSet data, at last check. Investors will get a fresh reading on the confidence of homebuilders on Monday morning at 10 a.m. Eastern Time. Meanwhile, the yield on the 10-year Treasury note

TMUBMUSD10Y,

was up about two basis points on Monday morning at around 4.35%, while two-year Treasury rates

TMUBMUSD02Y,

rose about three basis points to around 5.06%, FactSet data show, at last check. On Friday, the S&P 500 and Nasdaq each booked back-to-back weekly losses while the Dow eked out a slight gain for the week.

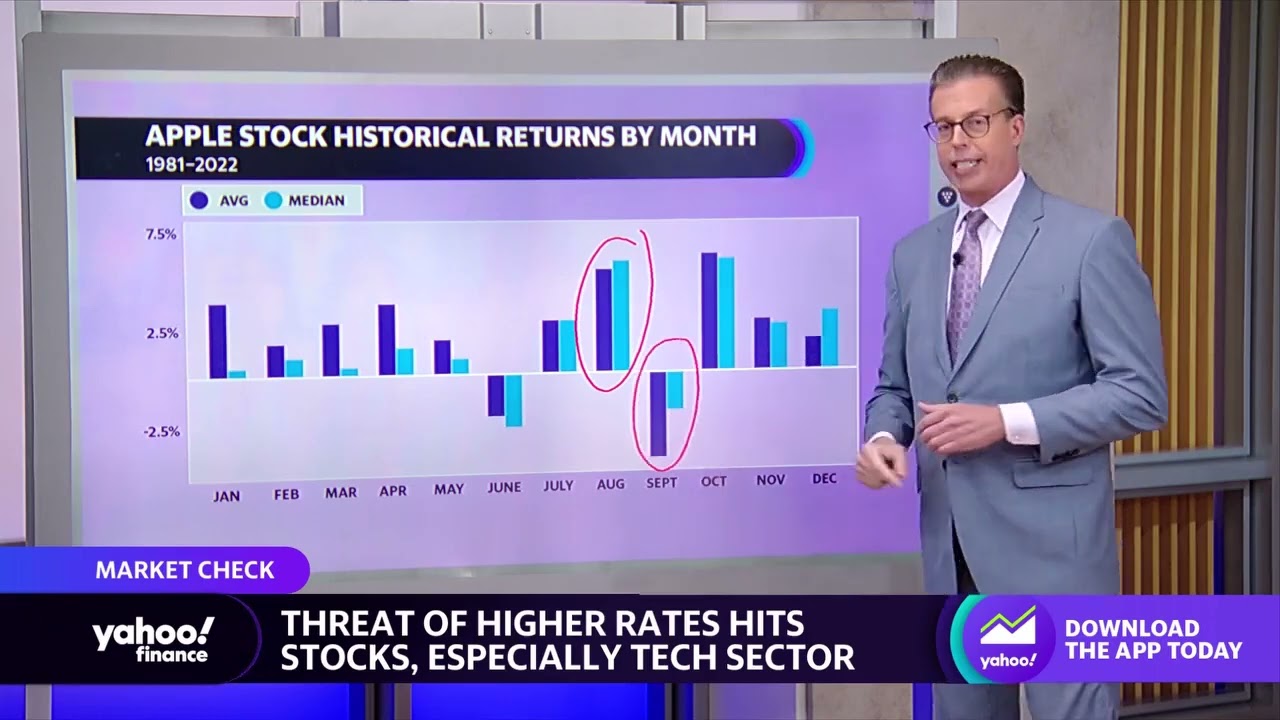

Apple stock sells off: Here's a look at the losses and what investors can expect moving forward

Incyte shares drop after FDA approves GSK’s competing blood-cancer treatment

Incyte Corp.

INCY,

shares dropped more than 5% premarket on Monday after the U.S. Food and Drug Administration on Friday approved a GSK PLC

GSK,

blood-cancer treatment, Ojjaara, that will compete with Incyte’s Jakafi. The FDA approved Ojjaara for use in patients with myelofibrosis, a rare blood cancer, with anemia. Ojjaara will likely put pressure on uptake of Jakafi as a first-line treatment for myelofibrosis, Truist Securities analysts wrote in a note Friday. The analysts maintained their buy rating on Incyte shares, saying they don’t anticipate that Ojjaara will impact Jakafi revenues from two other conditions, polycythemia vera and graft-versus-host disease. Incyte shares have dropped more than 22% in the year to date, while the S&P 500 has gained 15.9%.

Investor Alert: 3 Red-Hot Opportunities You Can’t Afford to Miss Investor Alert: 3 Red-Hot Opportunities You Can’t Afford to Miss

Among thousands of stocks, the article lists three companies that have defied expectations and emerged as industry titans. They are poised to shape the future of healthcare, entertainment, and consumer technology. The trio has adapted and thrived in the changing landscape, redefining their respective industries. These make them hot investing opportunities.

The first one’s cutting-edge virtual care solutions have ignited a healthcare revolution, meeting the rising demand for holistic, whole-person care strategies. The second one has carved a path to entertainment dominance across platforms with its rich content legacy and global production prowess.

Meanwhile, third’s strategic pricing and market expansion drive record growth and market penetration. The article explores how the first is transforming healthcare, how the second is redefining content creation and distribution, and how the third is capturing the imagination of adventurers worldwide.

So here are the hot investing opportunities worth considering.

Teladoc Health (TDOC)

Teladoc Health (NYSE:TDOC) is on track to meet its full-year enrollment targets. It is indicating sustained demand for its comprehensive virtual care solutions. The company has positioned itself as a leader in the shift toward whole-person care strategies. More clients recognize the value of a holistic approach to healthcare, with over one-third of chronic care members now enrolled in multiple programs.

BetterHelp, a subsidiary of Teladoc Health, continues to thrive as a leading player in the mental health services sector. BetterHelp’s segment revenue grew by an impressive 18% YoY, reflecting strong demand for mental health support. The stability in customer acquisition costs and improved gross margins indicate the sustainability of this growth.

Notably, the role of virtual care is expected to grow further in the coming years. Teladoc’s market survey shows that many employers plan to increase spending on virtual care, focusing on whole-person care strategies. This aligns with Teladoc’s core offerings, making it well-positioned to capture this growing market.

However, Teladoc Health is addressing the challenge of managing the cost of GLP-1 drugs, which are used for weight management and diabetes treatment. Employers and health plans seek cost-effective solutions, and Teladoc’s provider-based care programs, including the upcoming weight management program, are designed to meet this demand. This helps make it one of those hot investing opportunities.

Strategically, Teladoc Health is heavily investing in artificial intelligence across its business. Over 60 proprietary AI models are leveraged to enhance products and member experiences. AI helps optimize provider-patient matches, improve efficiency, and deliver personalized content and insights to members, ultimately leading to better outcomes and cost savings.

Finally, Teladoc Health’s partnership with Microsoft to integrate AI services and Nuance Dax’s capabilities into its platform highlights its commitment to innovation. Automation of clinical documentation during virtual exams will enhance efficiency and care quality.

Paramount (PARA)

Paramount (NASDAQ:PARA) has a rich history of creating high-quality content with mass appeal. They possess an extensive library spanning over 100 years, with over 200,000 TV episodes and 4,000 movies. This irreplaceable library is a cornerstone for Paramount+, Pluto TV, and content licensing, ensuring a constant revenue stream.

Additionally, Paramount boasts a global production capability, covering various markets, genres, and formats. Their ability to create, extend, and localize fan-favorite franchises and formats, such as Transformers, Mission Impossible, RuPaul’s Drag Race, and NCIS, enhances their content portfolio.

The growing roster of franchises that have grossed over $1 billion in revenue demonstrates Paramount’s ability to create enduring and profitable content. Their international production capabilities further diversify their content offerings, catering to a broad global audience. All in all, it’s one of those hot investing opportunities to consider.

Interestingly, Paramount leverages multiple platforms and revenue streams to maximize the value of its content. They monetize content through subscriptions, advertising, and content licensing. This multi-pronged approach ensures they can adapt to evolving market conditions and audience preferences.

Moreover, Paramount’s strength in digital advertising, with their EyeQ platform, generates significant revenue. It positions the company as a leader in the digital video ad space. Also, the company has expanded its international ad-supported streaming business and launched Pluto TV in multiple markets. Likewise, it plans to introduce ad-supported tiers of Paramount+ in select international markets, further increasing its ad revenue potential.

Furthermore, their integration of Paramount+ with Showtime and targeted programming strategy aim to optimize content expenses and improve margins, making their streaming service more efficient.

Paramount expects significant revenue growth by expanding its subscriber base, increasing average revenue per user (ARPU), and enhancing ad monetization. Finally, Paramount is focused on optimizing content and marketing spending, learning from subscriber behavior to tailor its content investments effectively.

GoPro (GPRO)

GoPro (NASDAQ:GPRO) has implemented a pricing strategy that involves returning to lower pre-pandemic price points. This strategy has already yielded positive results, with a 10% increase in revenue in Q2.

By offering cameras at more accessible price points, GoPro can capture a larger customer base, particularly in the entry-level segment, contributing to increased market penetration and growth opportunities.

Also, the company is placing renewed emphasis on its retail channels. By expanding global distribution to best-in-class retailers and engaging with influential core specialty retailers, GoPro aims to drive greater awareness and sell-through of its products. Opening new doors, particularly in regions like EMEA, presents a substantial growth opportunity.

Furthermore, GoPro is scaling its marketing spend to pre-pandemic levels, partnering with key retailers to amplify awareness and excite consumers. Collaborative activations with retailers and increased marketing efforts during product launches and holidays will contribute to sustained growth.

Strategically, GoPro’s subscription business continues to thrive, with a 27% YoY increase in subscribers. An attachment rate of over 40% from cameras purchased at retail highlights the value customers see in the subscription offering. Introducing an all-new desktop app for subscribers will enhance the user experience and drive further growth.

Notably, GoPro plans to expand its product lineup, including introducing a new entry-level camera with a significantly improved margin profile. This diversification can increase unit sales and revenue, attracting a broader customer base.

Finally, the company is aggressively pursuing global expansion, targeting approximately 2,000 new retail doors worldwide by the end of 2023. Despite some short-term challenges, GoPro expects to be profitable in the third and fourth quarters of 2023. Thus, the company anticipates improved retail sell-through and substantial growth in 2024, driven by the full-year benefits of its strategic shift.

As of this writing, Yiannis Zourmpanos held a long position in TDOC, PARA, and GPRO. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Joby Aviation looks to build 500 eVTOL aircraft a year, create 2,000 jobs at new Ohio facility

Shares of Joby Aviation Inc.

JOBY,

bounced 0.5% in premarket trading Monday, after the electric vertical take-off and landing air taxi developer said plant to build a new manufacturing facility in Dayton, Ohio that is capable of producing up to 500 eVTOL aircraft a year. The company plans to invest up to $500 million, and expects up to $325 million in state and local incentives, as construction of the facility is expected to create up to 2,000 jobs. Construction is expected to begin in 2024 and the facility is expected to come online in 2025. Joby’s stock, which closed Friday at a three-month low, has dropped 11.6% over the past three months while the S&P 500

SPX,

has gained 0.9%.

7 Meme Stocks to Sell in September Before They Crash & Burn

Meme stocks burst onto the investment scene, notably when GameStop (NYSE:GME) launched to astronomical heights in 2021, leaving both seasoned investors and short sellers dumbfounded. Yet, this meteoric rise was a double-edged sword, spotlighting potential meme stocks to sell. The sizzle of GameStop’s success lured numerous speculators, with various meme stocks rising by double or even triple-digit margins. Most savvy participants recognized the fragile foundations of these stocks, but the allure of these trajectories proved too tempting to resist. Sadly, gravity took hold, pulling GameStop and others back down, erasing their dazzling gains. Hence, holding onto certain meme stocks now might be playing with fire.

Peloton (PTON)

Peloton (NASDAQ:PTON) is among these meme stocks to sell due to its horizon appearing rather clouded in the aftermath of product recalls and a noteworthy surge in insider stock sales. Its most recently released quarterly report showed per-share losses nearly doubling compared to market expectations with lackluster forward guidance, which led to multiple analyst downgrades.

Coupled with a rising churn rate and dreary new subscriber additions, one might ponder if the luxury exercise brand is at its saturation point amongst its target demographic. While its management points to seasonality as a culprit, the undeniable reality is that the company will continue to falter in the post-pandemic world, with inflationary pressures damaging future growth prospects. Amid this turbulence, whispers of a potential acquisition have become louder. A buyout might be the silver lining they’re hoping for — for the company’s sake and its investors.

Mullen Automotive (MULN)

Mullen Automotive (NASDAQ:MULN) is attempting to rise from its ashes, rallying significantly after a series of market updates, including a $25 million share buyback initiative. A bold maneuver, considering its share price has dropped 90% since February, compounded by a trio of reverse stock splits this year alone. Moreover, despite landing a $63 million purchase order recently, its balance sheets tell a story of a company in duress, grappling with massive operational outflows and a rising cash burn rate, which saw them expending roughly $70 million in the first half of this year.

Its second-quarter results showed zero revenues and steep losses as the spotlight shifts glaringly onto its operational inefficiencies, setting off alarms about the sustainability of its financial health. While its management remains buoyant, projecting sufficient capital to tide over a year, the massive gap between the company’s expenditures and anticipated revenue points to a major liquidity crunch.

WeWork (WE)

Next on the list of meme stocks to sell now is WeWork (NYSE:WE). The company’s been dealt a harsh hand by fate, with its primary business model of offering shared workspaces taking a monumental hit in the wake of the Covid-19 pandemic’s work-from-home mandate.

To make matters worse, its recent 10-Q filing carried a ‘going concern’ statement, triggering a steep decline in stock value. This inclusion wasn’t merely a reflection of external circumstances but a testament to its weak financials. Drilling into the numbers, the firm burned through a massive $246 million from its operations during the second quarter and reported meager liquidity of $680 million by the conclusion of June. Despite previous attempts at overhauling its balance sheets, the business’s core viability is in question. Moreover, alarm bells are ringing louder, with Wall Street firms exploring bankruptcy avenues for WeWork and the NYSE initiating steps to delist its warrants.

Carvana (CVNA)

Carvana (NYSE:CVNA) has enjoyed a meteoric rise this year, soaring over 930% since January. Yet, diving deeper into the company’s fundamentals and the broader market landscape raises major concerns. Recent Carfax data signals an industry-wide depreciation in used car valuations, and with the company already grappling with razor-thin margins, the trend is worrying. By noticing these falling prices, consumers are more likely to opt for local bargains over Carvana’s pricier home delivery service.

Moreover, car financing costs climb as the Federal Reserve continues to hike interest rates. Despite used car prices showing a modest decline, they’re still considerably higher than pre-pandemic levels, as my fellow InvestorPlace contributor Rich Duprey discussed. He highlighted how the average used car cost is $29,472, a 46% jump higher from pre-Covid times on Edmunds.

Morgan Stanley’s analysts echo these reservations. Following Carvana’s sharp stock reversal, its recent downgrade suggests its valuation is unjustifiably high.

AMC Entertainment (AMC)

The stock market turbulence hasn’t spared movie theatre giant AMC Entertainment (NYSE:AMC). While its second-quarter performance showcased a 15.6% year-over-year (YOY) revenue spike and an encouraging net income of $8.1 million, a closer look reveals vulnerabilities. The company bled $13.4 million in its most recent quarter, set against the backdrop of a rather limited liquidity pool of $643 million, with a towering debt of over $9 billion casting a long and worrisome shadow.

AMC’s strategy of offloading its preferred equity units, aimed at buffering its debt, poses another problem involving potential shareholder dilution when these units convert to common shares. On top of that, there is the challenge of digital streaming and the scarcity of genuine blockbuster movies. With ongoing strikes in Hollywood, the content reservoir risks running even drier.

GameStop (GME)

While enthusiasts of GameStop remain optimistic, closer scrutiny paints a concerning picture. Not having tasted profit since 2018, the company’s situation appears dire. Even with Executive Chair Ryan Cohen’s commendable visions for reviving GameStop, the current economic dynamics hinder any immediate turnaround. Moreover, its status as a consumer discretionary stock will likely face the brunt when consumers tighten their belts.

While surpassing expectations and recording a 2.4% YOY growth largely due to strong software sales, GameStop’s recent second-quarter figures do little to negate the underlying issues. Additionally, there was a substantial 23.9% drop in collectible-related revenues, and despite the periodic improvements, the larger trajectory of GameStop appears uncertain. The continual erosion in collectible sales and hurdles in transitioning to digital gaming amplify these concerns. All indicators point towards caution, and those with stakes in GameStop might want to consider exiting sooner rather than later.

Fisker (FSR)

Fisker (NYSE:FSR), once riding high on the EV wave, is now facing the harsh realities of being an overvalued stock amidst a tightening economic environment. Moreover, recent announcements of substantial production cuts do little to boost confidence in this up-and-coming EV maker.

The numbers spell out the problem. Fisker’s had already reduced its current year production projection, initially set at 36,000 vehicles, slashing it further to somewhere between 20,000 and 23,000, a staggering dip from the previous estimate. This reduction is particularly concerning for a company that’s already eyeing greater market share. While aiming to mirror Tesla’s success in the luxury EV niche, Fisker’s efforts are faltering, evident from their Ocean SUV sales coming up short at just 1,022 units in the second quarter against a projected 1,700.

Fisker’s ambitious roadmap promises seven models by 2027 and a target of one million annual vehicle production by then. However, given the current trends, such aspirations seem more like a moonshot. You’ll definitely want to consider adding FSR to your list of meme stocks to sell.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.