Gold futures posted a modest gain on Tuesday to mark another settlement at their highest in over two weeks, a day ahead of the Federal Reserve’s decision on interest rates. “A hawkish decision would be decidedly bearish for gold…while a dovish surprise would support a run beyond $2,000” for gold, said analysts at Sevens Report Research, in Tuesday’s newsletter. December gold

GCZ23,

climbed by 30 cents, or less than 0.1%, to settle at $1,953.70 an ounce on Comex.

Don’t Get Head-Faked Into Buying Mullen Stock

Even low-confidence stocks can spike from time to time. Prospective investors might be tempted to take a chance on electric vehicle (EV) manufacturer Mullen Automotive (NASDAQ:MULN) after a sudden surge in MULN stock. Yet, for the long term, Mullen Automotive will probably just disappoint its loyal shareholders.

As we’ll discover, Mullen Automotive is dealing with a delisting threat and has financial issues to contend with. Yet, the company is spending money as if it is in terrific fiscal condition. It’s a recipe for disaster, so let’s delve into the worrisome details of this unusual automotive startup.

Why Did MULN Stock Jump 19%?

Again, even low-conviction stocks can have good days. For instance, MULN stock jumped 19.3% to 68 cents on Sept. 15. Bear in mind, though, that the stock traded at $8 at the beginning of 2023 and was much higher than that in 2021.

Still, I won’t deny that Mullen Automotive’s shareholders enjoyed a brief windfall on Sept. 15. So, what prompted this stock-price spike? It didn’t seem to have anything to do with Mullen’s announcement of new stops on the company’s “Strikingly Different” automotive tour, as this was disclosed on the morning of Sept. 14.

Presumably, the Sept. 15 catalyst was the the United Auto Workers (UAW) union strike. Apparently, this was bad news for automotive-market competitors Ford (NYSE:F), General Motors (NYSE:GM) and Stellantis (NYSE:STLA), and was therefore perceived as positive news for Mullen Automotive.

That catalyst was enough to prompt a single-day surge in MULN stock, but it doesn’t fix Mullen Automotive’s problems, which I will discuss momentarily. Besides, union-worker strikes can’t keep financial traders excited about Mullen Automotive forever. Headlines will come and go, but Mullen still needs to solve its major financial issues.

Mullen Automotive’s Big Purchases and Delisting Threat

So, let’s talk about Mullen Automotive’s financial problems now. For the quarter that ended the three months ending June 30, Mullen’s net loss attributable to common stockholders after preferred dividends ballooned to $308.9 million, or $11.14 per share. That’s a substantial per-share earnings loss, considering the company’s low share price.

For comparison, Mullen Automotive’s net loss was $7.1 million, or $4.26 per share, in the year-earlier quarter. It’s also worth mentioning that Mullen’s operating cash flow for the three months ending June 30 was deeply negative, at around -$46 million.

Nevertheless, Mullen Automotive is apparently glad to spend money on share buybacks and an approximately $3.5 million purchase of Romeo Power’s battery-pack production assets. (Nikola (NASDAQ:NKLA) acquired Romeo Power in 2022.)

Finally, I can’t ignore the elephant in the room. The Nasdaq exchange sent a delisting threat to Mullen Automotive because MULN stock failed to maintain a minimum $1 bid price for a prolonged period of time. Mullen has filed an appeal of the exchange’s potential-delisting notice, but this feels like an act of desperation.

Head-Fakes Can Trap Unwary Investors Into MULN Stock

Mullen Automotive might find a way to avoid imminent Nasdaq-exchange delisting. However, there may be more delisting threats in the future.

Furthermore, Mullen Automotive has deep financial issues. These include a widening net earnings loss and a penchant for spending money.

Therefore, if MULN stock head-fakes to the upside from time to time, these are probably traps. Frankly, it’s dangerous to invest in Mullen Automotive for the long term, and the risk of deep capital loss can’t be ignored.

Mullen might or might not manage to avert delisting from the Nasdaq exchange. Still, Mullen Automotive has significant problems to overcome, and cautious investors should seek EV-market returns elsewhere.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Instacart stock indicated to soar 30% at its open

Shares of Instacart

CART,

are set to receive a warm reception in their Wall Street debut, as early indications are for the grocery delivery app’s stock to open about 30% above where the initial public offering priced. While the stock isn’t expected to trade for a while, perhaps hours, the first indication from the Nasdaq was for the first trade to be around $39.00, while the IPO priced at $30 a share, according to FactSet data. At that price, the company, which is officially named Maplebear Inc. and doing business as Instacart, would be valued at about $13.2 billion, based on 338.8 million common shares outstanding (as-converted, fully diluted). In last week’s high-profile IPO of semiconductor-design company Arm Holdings PLC, the stock’s

ARM,

first trade was 10% above the IPO price, but it closed 24.7% above the IPO price on the first day.

Instacart stock opens with bang, as first trade is 40% above the IPO price

Maplebear Inc., which is doing business as Instacart

CART,

debuted on Wall Street with a bang Tuesday, as the grocery-delivery app’s stock opened 40% above where its initial public offering priced. The company said late Monday that its IPO of 22 million shares priced at $30 a share, which was at the top of the expected range. The first trade was at $42.00 at 12:49 p.m. Eastern for 2.59 million shares. At that price, the company would be valued at $14.2 billion, based on 338.8 million as-converted, fully diluted shares outstanding after the IPO. The stock has eased slightly since the open, and was last up 38.9%. The company went public at a time that investor interest in IPOs has waned of late, relative to interest in the broader stock market, as the Renaissance IPO ETF

IPO,

has lost 1.4% over the past three months while the S&P 500

SPX,

has edged up 0.2%.

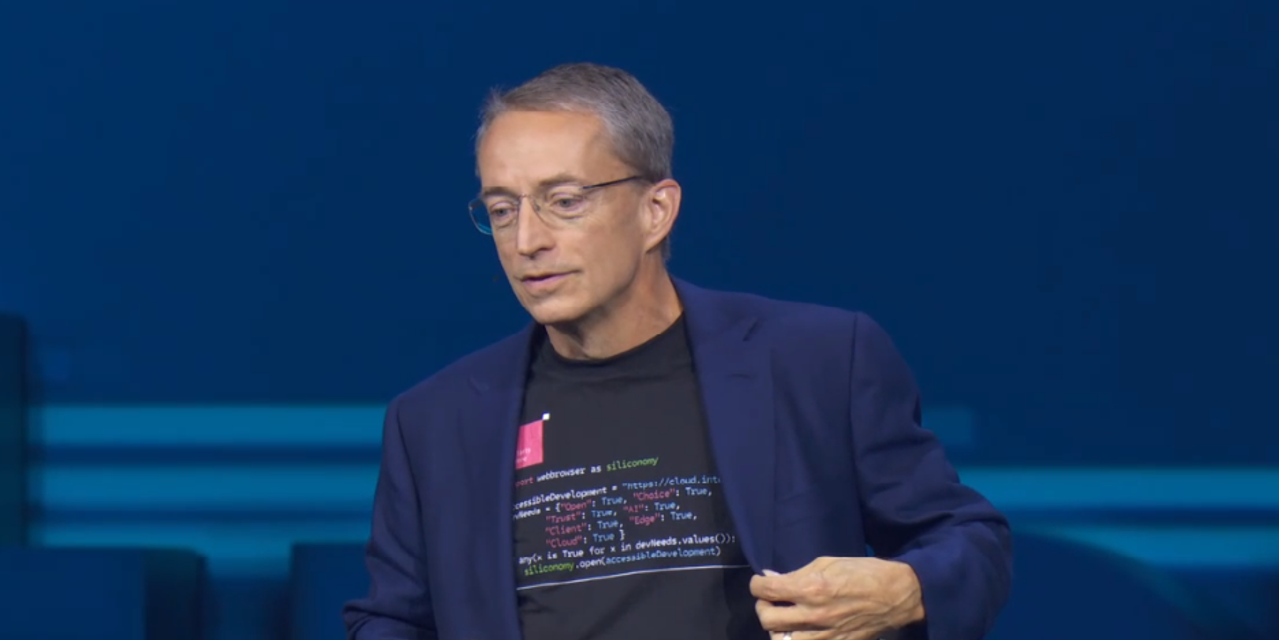

Intel kicks off developer conference with AI for PC chips

Intel Corp. kicked off its developer conference Tuesday with plans to launch PC chips with AI capability.

Intel

INTC,

said it was launching its Core Ultra processors, with the company’s first integrated neural processing unit, which will “deliver power-efficient AI acceleration and local inference on the PC, on Dec. 14.

Intel will also release its 5th gen Intel Xeon processors, on Dec. 14. In his keynote at Innovation 2023, Intel Chief Executive Pat Gelsinger said AI was allowing the $574 billion chip industry to feed an estimated $8 trillion “siliconomy,” or a “growing economy enabled by the magic of silicon and software.”

Intel also announced that it is building a large AI supercomputer using its Gaudi 2 accelerators with generative AI company Stability AI as the anchor customer.

Intel shares were down more than 3% in recent activity while the S&P 500 index

SPX,

declined 0.7%.

Amazon to hire 250,000 employees for the holidays, or 67% more than a year ago

Amazon.com Inc.

AMZN,

said Tuesday that it will hire 250,000 seasonal employees in the U.S. for the holidays, which is 100,000 more than a year ago. The ecommerce behemoth’s stock fell 2.8% in midday trading, and has shed 6.1% amid a four-day losing streak, since it closed at a 13-month high of $144.85 on Sept. 13. The company said it was investing $1.3 billion toward pay increases for customer fulfillment and transportation employees, bringing the average hourly pay to $20.50, up 7.9% from the average pay of $19 a hour a year ago. In some locations, Amazon said the pay would be as much as $28 an hour. “Whether someone is looking for a short-term way to make extra money, or is hoping to take their first step toward a fulfilling and rewarding career at Amazon, there’s a role available for them,” said John Felton, senior vice president of worldwide operations at Amazon. The stock has soared 62.0% year to date, while the S&P 500

SPX,

has gained 15.2%.

UpHealth subsidiary files for bankruptcy after unfavorable court ruling

Digital health company UpHealth Inc.

UPH,

said Tuesday that its UpHealth Holdings subsidiary has declared for bankruptcy. UpHealth, which went public public on June 10, 2021 after the completion of its merger with special purpose acquisition company (SPAC) GigCapital2 Inc., said it expects to keep operating “in the normal course.” The stock was down as much as 58% in the premarket before being halted, and has yet to trade since the opening bell. The bankruptcy filing comes after a trial court’s decision on Sept. 14 to grant summary judgment in favor of Needham & Co. LLC in a lawsuit unrelated to the company’s operations. The court’s decision said Needham was entitled to fees of $31.35 million. “Following the summary judgement, we immediately initiated a comprehensive review of our options, and determined that voluntarily filing for Chapter 11 is necessary to mitigate the financial impact of the trial court’s decision,” said Chief Executive Sam Meckey. “We do not expect this announcement to have any impact on our operations or on the work we are doing to deliver technology-enabled services to our customers.” UpHealth’s stock, which underwent a 1-for-10 reverse split in December, had plunged 39.9% year to date through Monday, while the S&P 500

SPX,

had advanced 16.0%.

Microsoft to lift dividend by 10%, though new implied yield still among the lowest for Dow dividend payers

Microsoft Corp.

MSFT,

is boosting its quarterly dividend by 10%, the company announced Tuesday. Microsoft’s new quarterly dividend will be 75 cents a share, 7 cents above what it was before. The dividend will be payable Dec. 14 to shareholders of record as of Nov. 16. Microsoft’s implied yield based on the new dividend is 0.91%, while its implied yield based on the current dividend is 0.83%. Microsoft is among the lowest-yielding members of the Dow Jones Industrial Average that pay dividends, as only Visa Inc.

V,

and Apple Inc.

AAPL,

yield less. Even with the announced hike, Microsoft’s implied yield would be below the current fourth-highest-yielding Dow component, as Intel Corp.’s

INTC,

stock yields 1.32%.

2-. 10-year Treasury yields on pace for highest levels since 2006-2007 ahead of Wednesday’s Fed decision

Treasury yields headed for their highest levels in well over a decade on Tuesday, as traders positioned for a higher-for-longer theme in rates following a batch of stronger-than-expected data last week. The policy-sensitive 2-year yield briefly touched 5.101% in morning trading before slipping to 5.088%. It was still on its way to the highest 3 p.m. Eastern time level since July 25, 2006, when it ended at 5.114%. The 10-year rate rose 2.3 basis points to 4.341%, heading for the highest closing level since Nov. 6, 2007. The moves come just one day before the Federal Reserve is expected to announce its next policy decision, with a 99% likelihood of no action seen on Wednesday. However, policy makers are set to release fresh interest-rate forecasts for 2024 and subsequent years.

Carnival, Deere, Super Micro Computer and more

The Carnival Miracle cruise ship operated by Carnival Cruise Line is docked at Pier 27 in San Francisco, Sept. 30, 2022.

Justin Sullivan | Getty Images

Check out the companies making headlines before the bell:

Carnival, Royal Caribbean— The cruise lines both gained about 2% after being upgraded by Truist. The Wall Street firm moved Royal Caribbean to buy from hold and Carnival to hold from sell, citing forward-looking trends for 2024 and 2025 that look “exceptionally strong.” Truist maintained its hold rating on Norwegian Cruise Lines, which was up more than 1% in premarket trading.

Deere, CNH Industrial — The two stocks slid in the premarket after Evercore ISI downgraded each to in-line from outperform, citing agricultural production cuts. Deere fell 1.4%, CNH declined 1.2%.

Starbucks — Shares fell 1.2% after TD Cowen downgraded the coffee giant over the “worrisome” macro backdrop in China. The firm believes slower consumer spending in China could hit share growth and affect Starbucks’ multiple.

CVS Health — The pharma stock rose less than 1% after Evercore ISI upgraded CVS Health Tuesday to outperform from in-line, saying the stock is currently attractively valued.

Dell Technologies — Shares rose more than 1.2% after Daiwa Capital Markets upgraded the computer stock to outperform from market perform. The Wall Street firm hiked its price target to $80 per share from $50, implying roughly 16% upside from Monday’s close.

Super Micro Computer — The information technology stock added more than 2% after Barclays initiated coverage of Super Micro Computer on Tuesday with an overweight rating. The firm’s $327 price target represents nearly 34% upside from Monday’s close.

Planet Fitness — The recent CEO shakeup at the gym franchise was a contributing factor in JPMorgan downgrading the stock to neutral from overweight. Along with the downgrade, the firm cut its price target on Planet Fitness to $52 from $70, a move that still implies 7% upside. Shares fell about 2% premarket.

Rocket Lab — The aerospace stock plunged 22% after Rocket Lab’s first launch failure in more than two years Tuesday morning. Shares closed Monday at $5.04.

— CNBC’s Michelle Fox and Hakyung Kim contributed reporting