Editor’s note: “3 Superior Hydrogen Stocks to Buy for the $11 Trillion Breakout” was previously published in February 2023. It has since been updated to include the most relevant information available.

Electric vehicles have become the dominant force in the global transition to a low-carbon future. They offer a clean and efficient way to power transportation with zero tailpipe emissions. However, this was not always the case. In fact, in 2003, hydrogen was seen as the most promising alternative to fossil fuels.

That year, President George W. Bush announced in his State of the Union speech that he envisioned a future where cars would run on hydrogen and emit only water. He was partly right. Today, there are some vehicles that use hydrogen fuel cells to generate electricity and produce no harmful pollutants. But they are far outnumbered by electric vehicles that use batteries to store energy.

What happened to the hydrogen dream?

According to Matthew Blieske, Shell’s (SHEL) global hydrogen product manager, “there was always something missing.” Hydrogen faced many challenges, such as high costs, lack of infrastructure, safety concerns, and technical issues. While some progress has been made in recent years, hydrogen still lags behind electric vehicles in terms of market share, consumer acceptance, and policy support.

The History of Hydrogen

Hydrogen fuel cells once promised to revolutionize the energy sector. They offered a way to break free from fossil fuels and reduce greenhouse gas emissions. But their promise faded as oil prices dropped and other clean energy sources became more competitive. Hydrogen production was costly, inefficient, and often dependent on natural gas. And so it was relegated to a minor role in the clean energy transition.

But this is all about to change.

Hydrogen is poised for a major comeback and will emerge as a key player in the decarbonization of the economy.

Why now?

Because technological innovations, policy support, and market demand are creating favorable conditions for hydrogen to flourish. New methods of producing hydrogen from renewable sources are becoming more efficient and affordable. Governments are setting ambitious targets and providing incentives for hydrogen deployment. And industries are looking for low-carbon solutions to meet their energy needs.

Hydrogen has unique advantages that make it suitable for a range of applications. It can store and transport large amounts of energy over long distances. It can complement intermittent renewables like solar and wind and power heavy-duty vehicles and machinery that are hard to electrify. And it can be used as a feedstock for various industrial processes.

Hydrogen is no longer a distant dream. It is a reality that is gaining momentum.

And the Hydrogen Economy is ready to take off.

The Drivers Have Arrived

Now as every country strives for a net-zero emissions target, the global political stage is set for mass decarbonization.

Hydrogen fuel cells have become more affordable thanks to economies of scale, dropping 60% in cost over the past decade. And further, Deloitte predicts that they will soon be cheaper than electric batteries and combustion engines.

Moreover, technological innovations and lower renewable energy costs have enabled the production of “Green Hydrogen” from clean energy sources, such as solar and wind.

This means that all the factors are aligned for the Hydrogen Economy to take off in the 2020s.

Blieske, Shell’s hydrogen expert, says: “We don’t see any barriers anymore. [In the past] there was a lack of policy, or the technology was not mature enough, or people were not serious about decarbonization.”

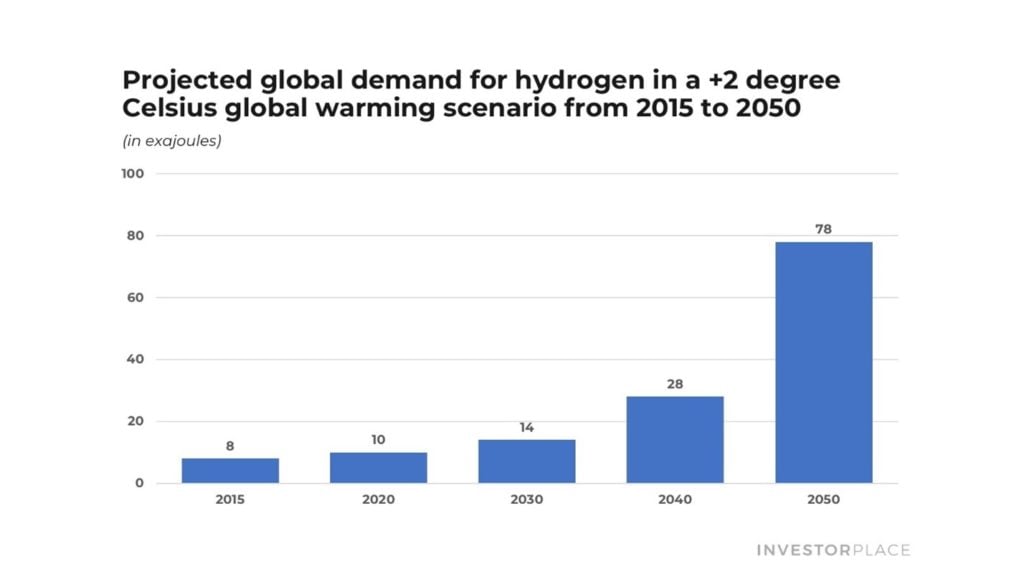

The Hydrogen Economy will unleash its full potential in the next decades, creating an $11 trillion market, according to Morgan Stanley (MS).

Source: InvestorPlace

The biggest opportunities will be in high-demand and long-distance energy and transportation sectors. That’s where hydrogen has an edge over electric batteries. And that’s where hydrogen stocks will soar.

The Final Word on Hydrogen Stocks

You see; when it comes to cost, efficiency, safety, and public roads infrastructure, battery electricity wins out. To that extent, battery electricity will likely be the dominant clean energy source for passenger cars and last-mile delivery vans.

But thanks to its unmatched energy density, hydrogen outplays battery electricity when it comes to range, recharging times, and emissions. So, in heavy-usage and long-range situations, hydrogen is best-in-class. Therefore, those fuel cells will likely be the dominant clean energy source for industry, stationary and cross-country hauling.

Think forklifts in warehouses, trucks that travel across the country, and ships that sail across oceans. And what about data centers that have to be “always on”?

Indeed, hydrogen fuel cells are on the cusp of disrupting those industries over the next decade.

Who is at the forefront of this multi-trillion-dollar disruption?

Plug Power (PLUG) – the company started out supplying hydrogen fuel cells for forklifts to warehouse operators like Walmart (WMT) and Amazon (AMZN). Now Plug Power is morphing into an all-in-one, vertically-integrated powerhouse at the epicenter of the Hydrogen Economy.

Needless to say, Plug Power stock is a long-term winner.

But other names are also piquing interest in this hypergrowth space…

Like Ballard Power (BLDP), who’s making hydrogen fuel cells for buses, trucks, and trains. And Bloom Energy (BE) is creating energy “boxes” powered by green hydrogen to help replace grid power.

With these hypergrowth hydrogen stocks, you have three of the highest-quality plays on a multi-trillion-dollar revolution. And they’re three stocks that could easily rise several hundred percent in the 2020s.

Hypergrowth investors should take a good hard look at these emerging hydrogen stocks.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.